Introduction to ICT Trading 📈

Inner Circle Trader (ICT) methodology has revolutionized how we understand market dynamics and institutional behavior. Created by Michael J. Huddleston, ICT concepts focus on smart money movements and how retail traders can align themselves with institutional flows rather than fighting against them.

The ICT strategy encompasses several key concepts including Order Blocks, Fair Value Gaps (FVGs), Liquidity Zones, and Market Structure Shifts. These concepts help traders identify where institutional money is likely to enter or exit positions, creating high-probability trading opportunities.

Core ICT Strategies Include:

- 🎯 Order Block Trading: Identifying institutional supply and demand zones

- 📊 Fair Value Gap Analysis: Spotting imbalances in price action

- 💧 Liquidity Sweeps: Understanding how smart money hunts stops

- 🔄 Market Structure Analysis: Reading the overall market direction

- ⚡ Premium/Discount Zones: Timing entries based on value areas

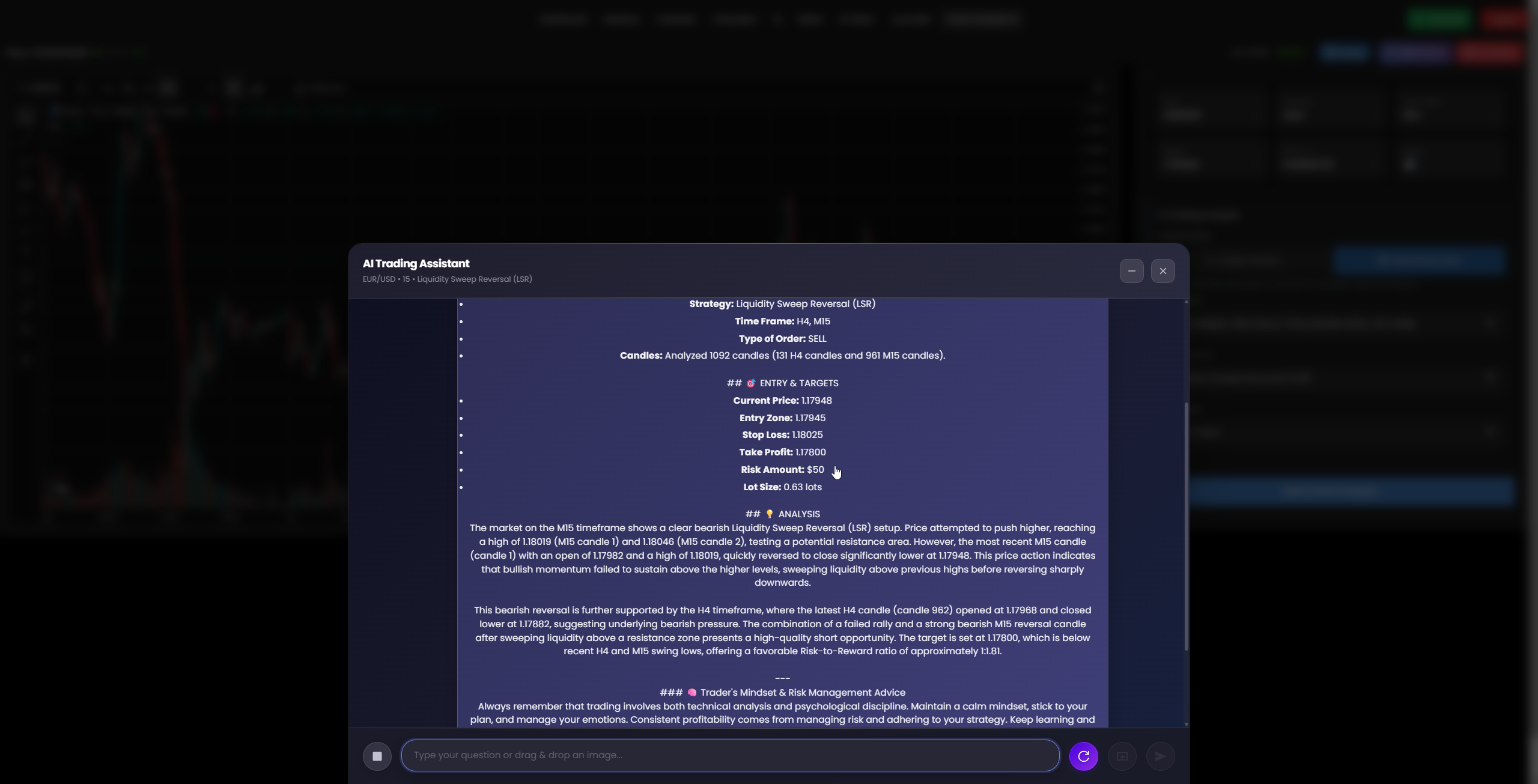

AI-powered ICT analysis in action

Common Challenges for Traders 😰

While ICT concepts are powerful, many traders struggle with their implementation. The complexity of identifying correct levels, maintaining psychological discipline, and the time-consuming nature of manual chart analysis often leads to inconsistent results.

😵 Difficulty Identifying Levels

Many traders struggle to correctly identify order blocks, FVGs, and liquidity zones, leading to poor entry and exit decisions.

🧠 Psychological Discipline

Emotional trading and lack of discipline often cause traders to deviate from their ICT-based trading plans.

⏰ Time-Consuming Analysis

Manual chart analysis requires hours of screen time, making it difficult for part-time traders to implement effectively.

📉 Inconsistent Results

Without proper automation and systematic approach, traders often experience inconsistent performance.

Role of Artificial Intelligence in ICT 🤖

Artificial Intelligence transforms ICT trading by automating the complex analysis required to identify institutional patterns. AI can scan multiple charts simultaneously, detect ICT patterns with high accuracy, and generate higher-probability setups without emotional bias.

How AI Enhances ICT Trading:

- ⚡ Lightning-Fast Analysis: AI can analyze hundreds of charts in seconds, identifying patterns that would take hours manually

- 🎯 Pattern Recognition: Machine learning algorithms excel at recognizing complex ICT patterns with high accuracy

- 📊 Multi-Timeframe Analysis: AI simultaneously analyzes multiple timeframes to confirm setups

- 🚫 Emotion-Free Trading: AI eliminates psychological biases that often lead to poor trading decisions

- 📈 Continuous Learning: AI systems improve over time by learning from market data and trading outcomes

AI detecting ICT patterns across multiple timeframes

The integration of AI with ICT concepts creates a powerful synergy. While ICT provides the theoretical framework for understanding institutional behavior, AI provides the computational power to implement these concepts at scale and with precision that's impossible for human traders to achieve manually.

Integration of ICT with AI 🔗

The integration process involves training AI systems to recognize and interpret ICT concepts automatically. This includes detecting order blocks, identifying fair value gaps, and recognizing liquidity zones with machine-learning precision.

🎯 AI Detects Order Blocks

Machine learning algorithms identify institutional supply and demand zones by analyzing price rejection patterns and volume data.

📊 FVG Recognition

AI automatically spots fair value gaps and imbalances in price action that often lead to strong directional moves.

💧 Liquidity Zone Analysis

Advanced algorithms identify areas where institutional players are likely to hunt for liquidity, creating trading opportunities.

🚫 False Signal Filtering

AI filters out low-probability setups by analyzing multiple confirmation factors simultaneously.

Two Main Approaches for AI-ICT Integration:

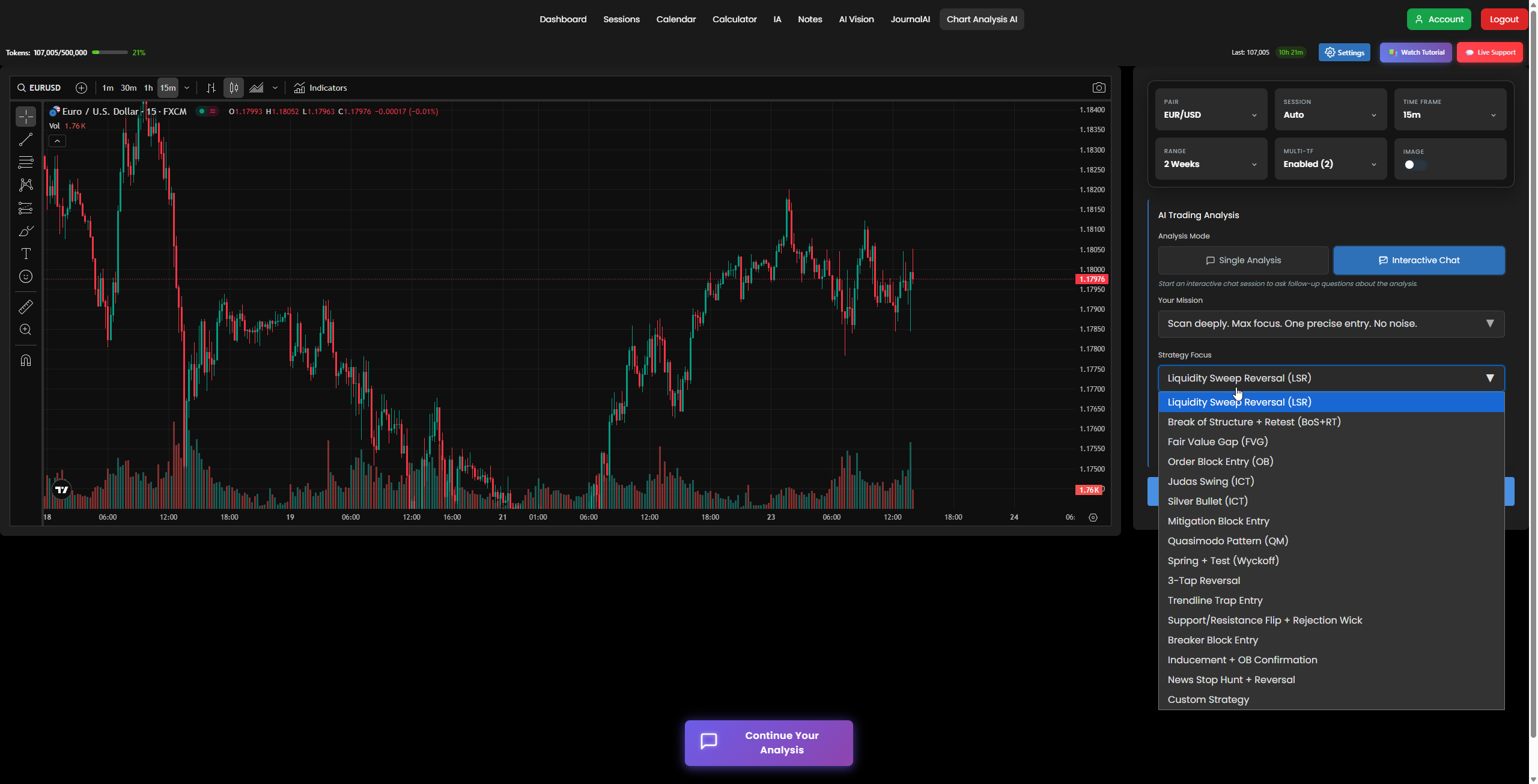

Option 1: Image-Based Analysis 📸

Send chart images to AI for analysis. However, this approach is limited because many AI systems don't have good performance in detecting multiple zones and complex patterns from images alone.

Option 2: Real Market Data Analysis 📊 (Recommended)

Send real market data (OHLC) to AI. Select the specific ICT strategy, set the rules like pair and timeframe, then send the OHLC data to AI. The AI will process the data and provide the best zones found. This approach is much more effective!

To use ICT and AI effectively, you should select the strategy first, then choose the timeframe and pair, and send all this information to AI for analysis. This systematic approach ensures that the AI understands exactly what you're looking for and can provide more accurate results.

Risk Management with AI 🛡️

One of the most significant advantages of using AI in ICT trading is its ability to enforce strict money management rules consistently. Unlike human traders who might deviate from their risk management plan due to emotions, AI systems maintain discipline 24/7.

AI-Powered Risk Management Features:

- 💰 Position Sizing: AI calculates optimal position sizes based on account balance and risk tolerance

- 🛑 Stop Loss Placement: Automatic stop loss placement based on ICT levels and volatility analysis

- 🎯 Take Profit Optimization: AI determines optimal exit points using multiple ICT concepts

- 📊 Risk-Reward Analysis: Every trade is evaluated for minimum risk-reward ratios before execution

- ⚖️ Portfolio Balance: AI ensures proper diversification across different pairs and strategies

AI-powered risk management dashboard showing real-time analysis

The AI system continuously monitors market conditions and adjusts risk parameters accordingly. For example, during high volatility periods, it might reduce position sizes or tighten stop losses to protect capital. This dynamic approach to risk management is something that would be very difficult for human traders to implement consistently.

Practical Implementation 🛠️

Implementing ICT trading with AI requires a systematic approach. Here's how you can get started with this powerful combination:

Step 1: Choose Your ICT Strategy 📋

Select the specific ICT concept you want to focus on - whether it's order blocks, FVGs, liquidity sweeps, or market structure analysis.

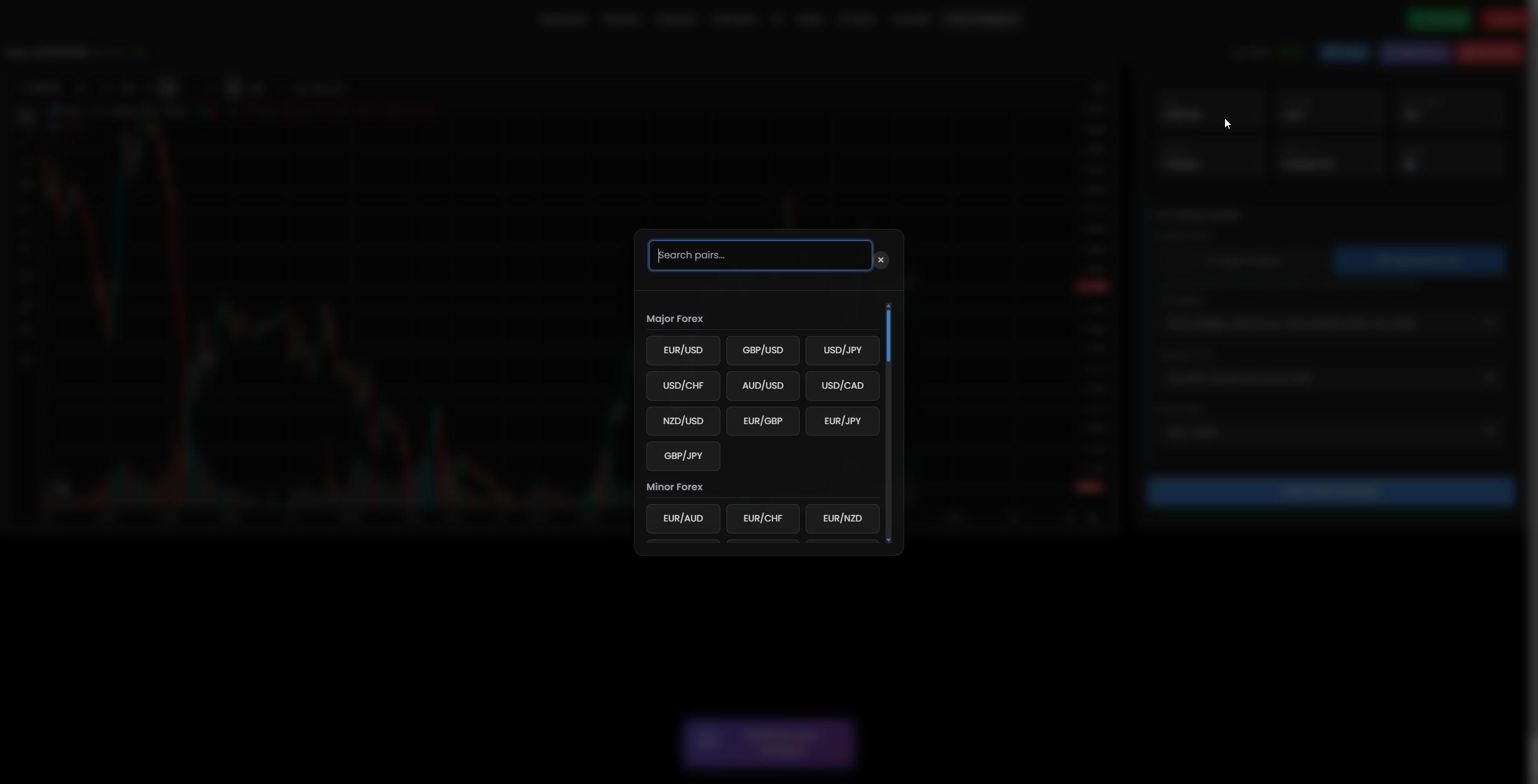

Step 2: Set Parameters ⚙️

Define your trading parameters including currency pairs, timeframes, risk tolerance, and specific rules for your chosen strategy.

Step 3: Feed Data to AI 📊

Provide the AI system with real market data (OHLC) along with your strategy parameters for analysis and pattern recognition.

Step 4: Review AI Analysis 🔍

Examine the AI's findings, including identified zones, probability scores, and recommended entry/exit points.

Step 5: Execute with Confidence 🚀

Execute trades based on AI recommendations while maintaining proper risk management and position sizing.

Implementation Flow 🔄

Upload Chart

Upload your trading chart to the AI system

AI Analysis

AI processes and analyzes market patterns

Pattern Detection

Identifies ICT patterns and key levels

Signal Generation

Generates trading signals with probability scores

Execute Trade

Execute trades with proper risk management

Conclusion 🎯

The combination of ICT trading concepts with artificial intelligence represents a significant leap forward in retail trading capabilities. By automating the complex analysis required for ICT strategies, AI eliminates many of the barriers that prevent traders from successfully implementing these powerful concepts.

Whether you're a beginner looking to learn ICT concepts or an experienced trader seeking to improve consistency, AI-powered ICT trading offers a path to more systematic and profitable trading. The key is to start with a clear strategy, use real market data for analysis, and maintain proper risk management throughout the process.

As AI technology continues to evolve, we can expect even more sophisticated implementations of ICT concepts, making institutional-level trading strategies accessible to retail traders worldwide. The future of trading is here, and it's powered by the perfect marriage of ICT wisdom and artificial intelligence! 🚀✨

Ready to Start Your AI-ICT Journey?

Join thousands of traders who are already using AI to enhance their ICT trading strategies. Experience the power of institutional-level analysis with the convenience of automated systems.

Explore MyForexAI Features →