Introduction to USD/CHF Analysis 🇺🇸🇨🇭

The USD/CHF currency pair, known as the "Swissie," represents one of the most stable and liquid forex pairs, with the Swiss Franc serving as a traditional safe-haven currency. Trading this pair during the Tokyo session offers unique opportunities for disciplined traders using advanced strategies. 💰

This comprehensive analysis explores the Liquidity Sweep Reversal (LSR) strategy on USD/CHF, combining institutional trading concepts with AI-powered market insights to identify high-probability reversal setups during optimal trading windows. 🎯

Understanding Liquidity Sweep Reversal (LSR) 🌊

The Liquidity Sweep Reversal (LSR) strategy is a sophisticated approach that capitalizes on institutional behavior patterns where large market participants deliberately sweep liquidity pools before reversing price direction. This creates exceptional entry opportunities for informed traders. ⚡

🔑 Core LSR Components:

- 🎯 Liquidity Pools: Areas where retail stop losses cluster (equal highs/lows, round numbers)

- 🌊 Liquidity Sweep: Institutional move to trigger stops and gather liquidity

- 🔄 Reversal Signal: Immediate rejection and change of character after sweep

- 📊 Market Structure: Break of structure (BOS) confirming new direction

- ⏰ Session Timing: Tokyo session characteristics for optimal execution

The strategy works by identifying when smart money (banks, hedge funds, institutions) deliberately moves price to sweep retail liquidity before establishing their true directional bias, creating high-probability reversal opportunities. 🏦

Strategy Implementation & Timing ⏰

🌟 Optimal LSR Trading Windows

🇯🇵 Tokyo Session Focus

Time: 00:00 - 09:00 GMT

Best for: Lower volatility, cleaner setups, institutional positioning

🇨🇭 Swiss Market Hours

Time: 07:00 - 16:00 GMT

Best for: CHF strength plays, central bank influence

🔍 LSR Implementation Steps

- Market Structure Analysis: Identify higher timeframe trend and key liquidity levels

- Liquidity Pool Identification: Mark equal highs/lows where stops likely reside

- Sweep Confirmation: Wait for price to sweep liquidity with momentum

- Reversal Signal: Look for immediate rejection and change of character

- Entry Execution: Enter on lower timeframe confirmation with tight risk

📈 Live Trading Setup Analysis

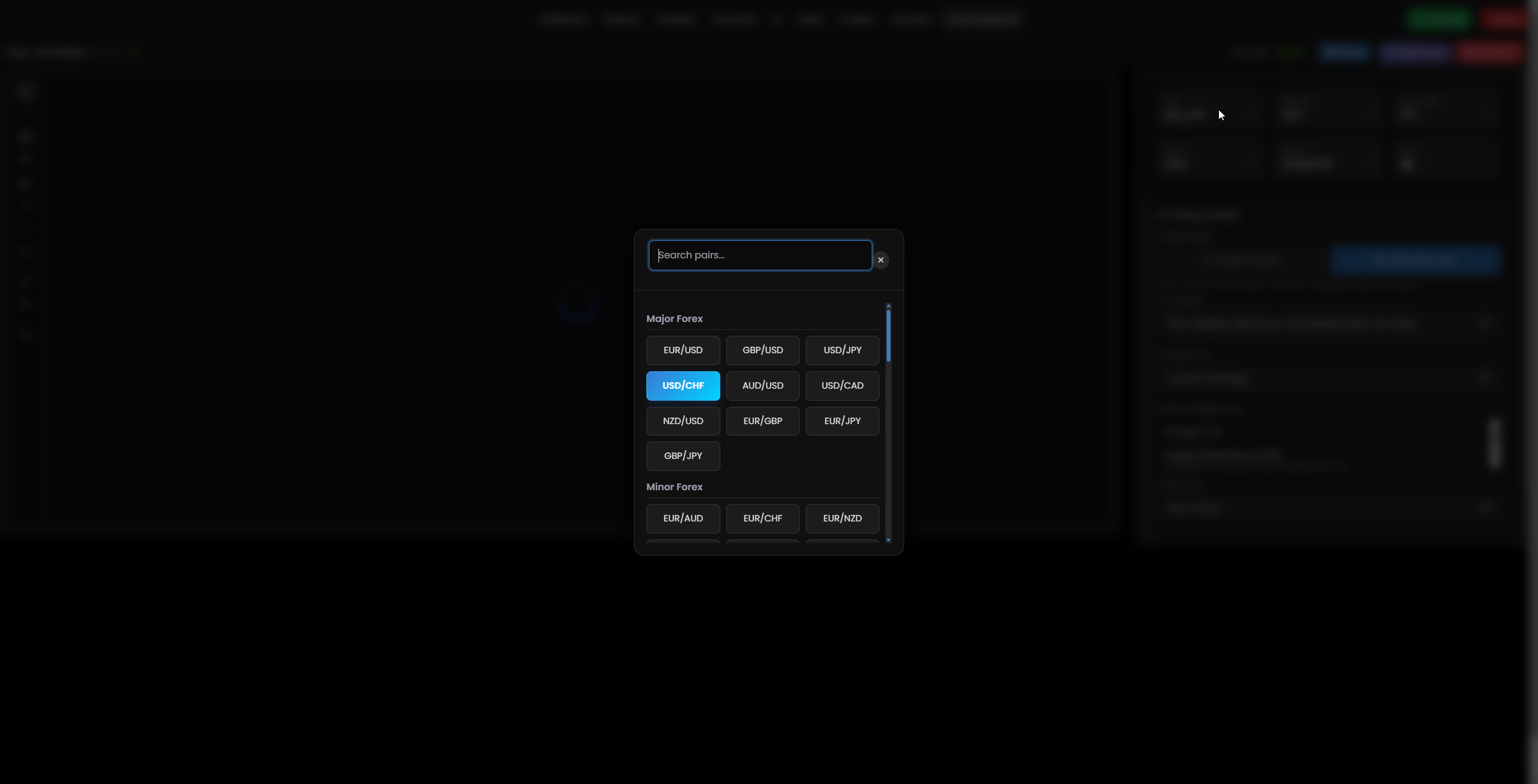

💱Selected Currency Pair Interface

Currency pair selection interface showing USD/CHF as the chosen trading instrument for the Liquidity Sweep Reversal strategy analysis

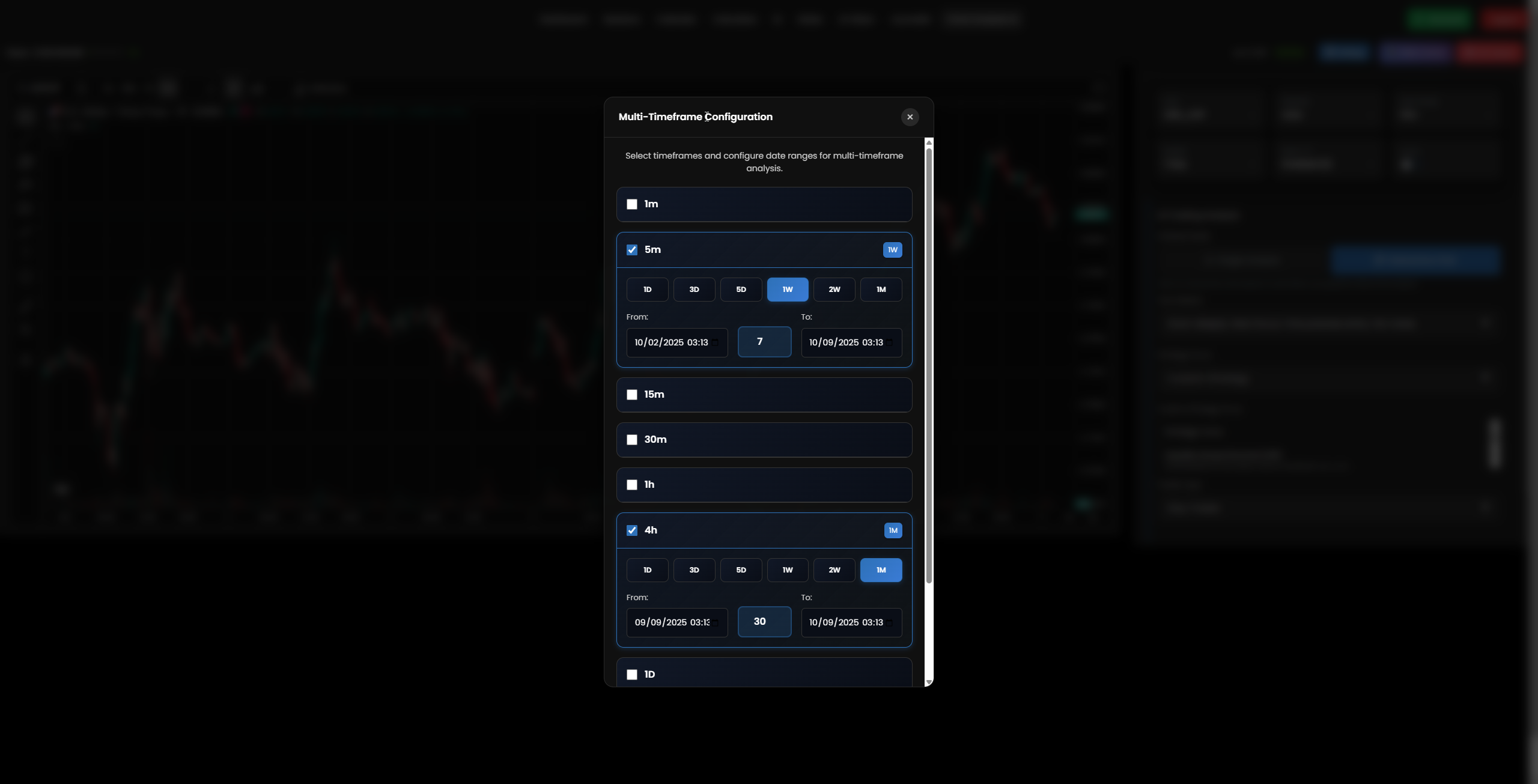

⏰Time Frame Selection Interface

Multi-timeframe selection interface optimized for LSR strategy implementation using H4 for structure and M5 for precise entry timing

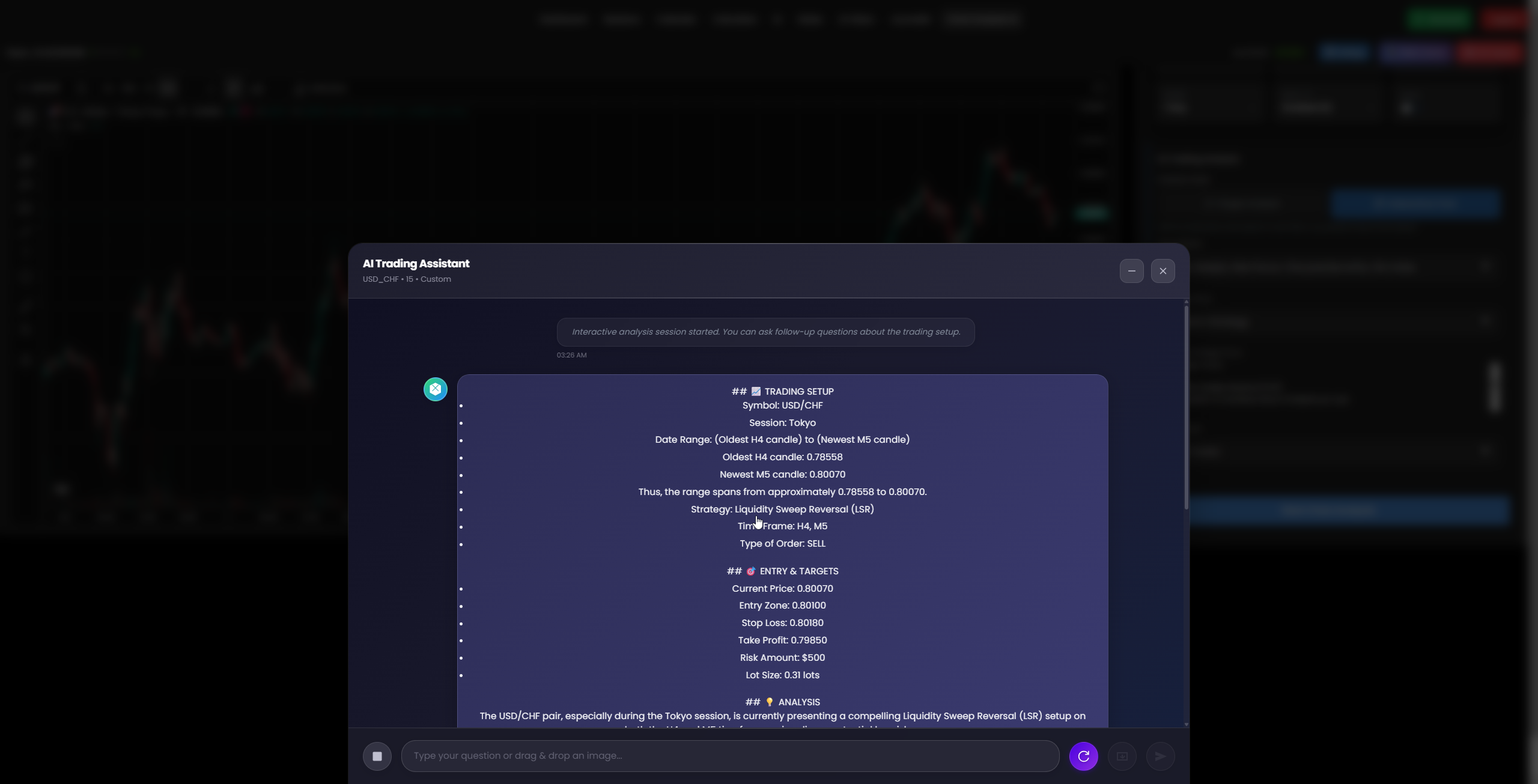

🎯TRADING SETUP

🎯ENTRY & TARGETS

Current Price

0.80070

Entry Zone

0.80100

Stop Loss

0.80180

Take Profit

0.79850

Lot Size

0.31 lots

💡Comprehensive Market Analysis

The USD/CHF pair, especially during the Tokyo session, is currently presenting a compelling Liquidity Sweep Reversal (LSR) setup on both the H4 and M5 timeframes, signaling a potential bearish move with high institutional participation. 📊

🕐 H4 Timeframe Analysis

On the higher H4 timeframe, we observe a sustained upward trend that has recently approached a significant resistance level around 0.80100-0.80200. The most recent H4 candles show strong upward momentum, pushing into new highs with candle highs reaching 0.80294 and 0.80281. However, the latest candles indicate a slowing of momentum and struggle to maintain higher prices, with clear exhaustion signals near the 0.80200 area. This represents a clear zone where institutional liquidity might be resting above previous highs, creating the perfect setup for a liquidity sweep. 📈

⚡ M5 Timeframe Confirmation

Zooming into the M5 timeframe provides crucial confirmation of this sentiment. Recent M5 candles demonstrate a strong push towards and slightly above the 0.80200 level, reaching highs around 0.80294. This move appears to be a classic sweep of short-term liquidity accumulated above previous highs. Following this sweep, subsequent candles show clear signs of rejection and failure to sustain these higher prices, with the formation of candles displaying upper wicks and bearish closes after touching these highs. This indicates that buyers are losing control and institutional sellers are stepping in to defend the level. 🎯

🔄 Liquidity Sweep Mechanics

The current price action on M5 at 0.80070 suggests that the market is attempting a reversal after successfully sweeping liquidity. The institutional behavior pattern is clear: large players have deliberately pushed price above obvious resistance to trigger retail stop losses and gather liquidity before establishing their true bearish bias. This creates an optimal environment for a short entry (SELL) around the 0.80100 mark, anticipating a continuation of this bearish reversal as smart money begins their distribution phase. 🌊

🛡️ Risk Management Strategy

The stop loss is strategically placed at 0.80180, just above the highest point of the liquidity sweep, providing adequate room for minor fluctuations while protecting against a false reversal. This placement accounts for the Tokyo session's typically lower volatility while ensuring protection if institutional sentiment changes. The risk amount of $500 with a lot size of 0.31 lots maintains proper risk management principles, never risking more than a small percentage of total capital. 🔒

🎯 Profit Target Rationale

The take profit target at 0.79850 aims for a retest of previous support levels where new liquidity might be found for potential bounce or further breakdown. This level represents a logical profit-taking zone where institutional buyers may step in, providing a favorable risk-reward ratio. The setup aligns perfectly with the LSR strategy, identifying a clear sweep of liquidity followed by strong rejection, signaling a high-probability reversal with institutional backing. 💰

Risk Management & Trading Wisdom 🛡️

📊AI Analysis Results Interface

Complete AI analysis results showing market structure, liquidity sweep identification, risk assessment, and trading recommendations for USD/CHF LSR strategy

🧠 Trading Wisdom & Psychology

Remember, trading is a marathon, not a sprint. Focus on maintaining a calm and disciplined mindset throughout your trading journey. Technical analysis provides valuable insights, but emotional control is the key to consistent success. The LSR strategy requires patience to wait for the perfect setup rather than forcing trades. 🧘♂️

💡 Professional Insight: Always respect your risk management plan, regardless of how strong a setup appears. A small, consistent win is always better than a large, risky gamble. Stay patient, stay focused, and trust your process.

🚨 Critical Risk Rules

- • Never risk more than 1-2% per trade

- • Always honor your stop loss placement

- • Account for spread and slippage costs

- • Use proper position sizing calculations

- • Maintain detailed trading journal records

📈 Success Principles

- • Focus on process over profits

- • Wait for high-probability setups only

- • Maintain consistent risk-reward ratios

- • Practice patience and discipline daily

- • Continuously educate and improve skills

⚠️ Essential Risk Management Note

Always ensure your stop loss is honored, and never risk more than a small, predefined percentage of your total capital on any single trade. This protects your account from unexpected market movements and allows you to trade another day. The LSR strategy, while powerful, requires strict adherence to risk management principles to achieve long-term success. 🔐

🎥AI Tools Demonstration Video

Step-by-step demonstration of using AI trading tools for USD/CHF analysis and LSR strategy implementation

Conclusion & Key Takeaways 🎯

The Liquidity Sweep Reversal (LSR) strategy on USD/CHF, when executed with proper timing and risk management, provides a systematic approach to capturing institutional moves with high probability setups. Success requires patience, discipline, and strict adherence to the strategy's core principles. 📊

✅ Key Success Factors

- • Master Tokyo session timing and characteristics

- • Identify liquidity pools accurately on multiple timeframes

- • Wait for clear liquidity sweep confirmation

- • Execute entries only after reversal signals

- • Maintain strict risk management discipline

- • Use AI analysis for confluence confirmation

- • Keep detailed records of all LSR setups

- • Continuously refine pattern recognition skills

Remember, consistent profitability in forex trading comes from executing a proven strategy with unwavering discipline rather than seeking perfect trades. The LSR methodology, combined with proper risk management and AI-enhanced analysis, provides the edge needed for long-term success in USD/CHF trading. Stay patient, trust the process, and let the market come to you. 🚀