Introduction to USD/CAD Analysis 🍁

The USD/CAD currency pair, affectionately known as the "Loonie," represents one of the most traded commodity currencies in the forex market. With over $200 billion in daily trading volume, this pair offers exceptional opportunities for traders who understand institutional behavior patterns. 💰

Today's analysis focuses on the Liquidity Sweep Reversal (LSR) strategy - a powerful technique that capitalizes on institutional manipulation before significant price reversals. As a professional trader with years of experience, I'll walk you through this high-probability setup that smart money uses to trap retail traders. 🎯

Understanding Liquidity Sweep Reversal (LSR) 🌊

The Liquidity Sweep Reversal is the holy grail of institutional trading patterns. It occurs when smart money deliberately pushes price beyond obvious support or resistance levels to trigger retail stop losses, creating a liquidity pool that institutions can use for their massive orders. 🏦

🔑 LSR Key Components:

- 🎯 Liquidity Zones: Areas where retail traders place their stop losses (equal highs/lows)

- ⚡ False Breakout: Price briefly breaks key levels to trigger stops

- 🔄 Quick Reversal: Immediate price rejection back into the range

- 📊 Volume Confirmation: High volume during the sweep, low volume on reversal

- ⏰ Timing Precision: Often occurs during low liquidity periods (Asian session)

Think of LSR as institutional "stop hunting" - they need liquidity to fill their large orders, so they create it by triggering retail traders' stops. Once the liquidity is absorbed, price reverses in the intended direction. This is why understanding market structure is crucial for consistent profitability. 📈

Strategy Implementation & Market Structure ⚙️

🌟 LSR Implementation Framework

🔍 Identification Phase

Look for: Equal highs/lows on H4/H1

Confirm: Multiple touches at same level

⚡ Execution Phase

Entry: After sweep and rejection

Timing: M5 confirmation candle

🎯 Professional LSR Checklist

- Market Structure Analysis: Identify clear support/resistance with multiple touches

- Liquidity Assessment: Confirm retail traders are likely positioned beyond these levels

- Sweep Confirmation: Price breaks the level with momentum then immediately reverses

- Entry Timing: Wait for M5 rejection candle before entering the trade

- Risk Management: Place stop beyond the sweep high/low with proper position sizing

📈 Live Trading Setup Analysis

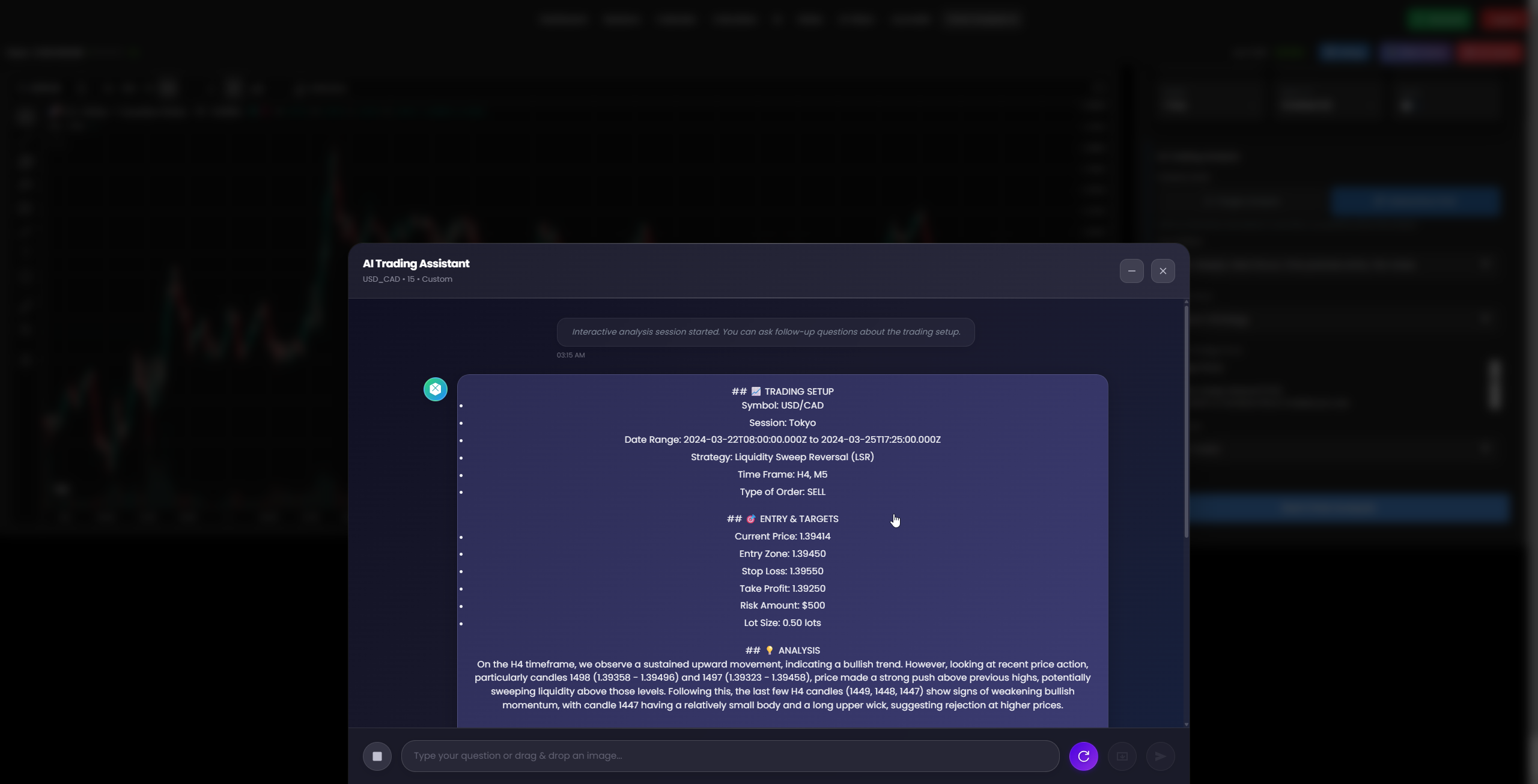

🎯TRADING SETUP

Symbol: USD/CAD 🍁

Session: Tokyo Session 🌅

Date Range: March 22-25, 2024

Strategy: Liquidity Sweep Reversal (LSR)

Time Frame: H4, M5 📊

Type of Order: SELL 📉

Risk Amount: $500 💰

Lot Size: 0.50 lots

🎯ENTRY & TARGETS

Current Price: 1.39414 📍

Entry Zone: 1.39450 🚪

Stop Loss: 1.39550 🛡️

Take Profit: 1.39250 🎯

Risk/Reward: 1:2 ⚖️

Potential Profit: $1,000 💎

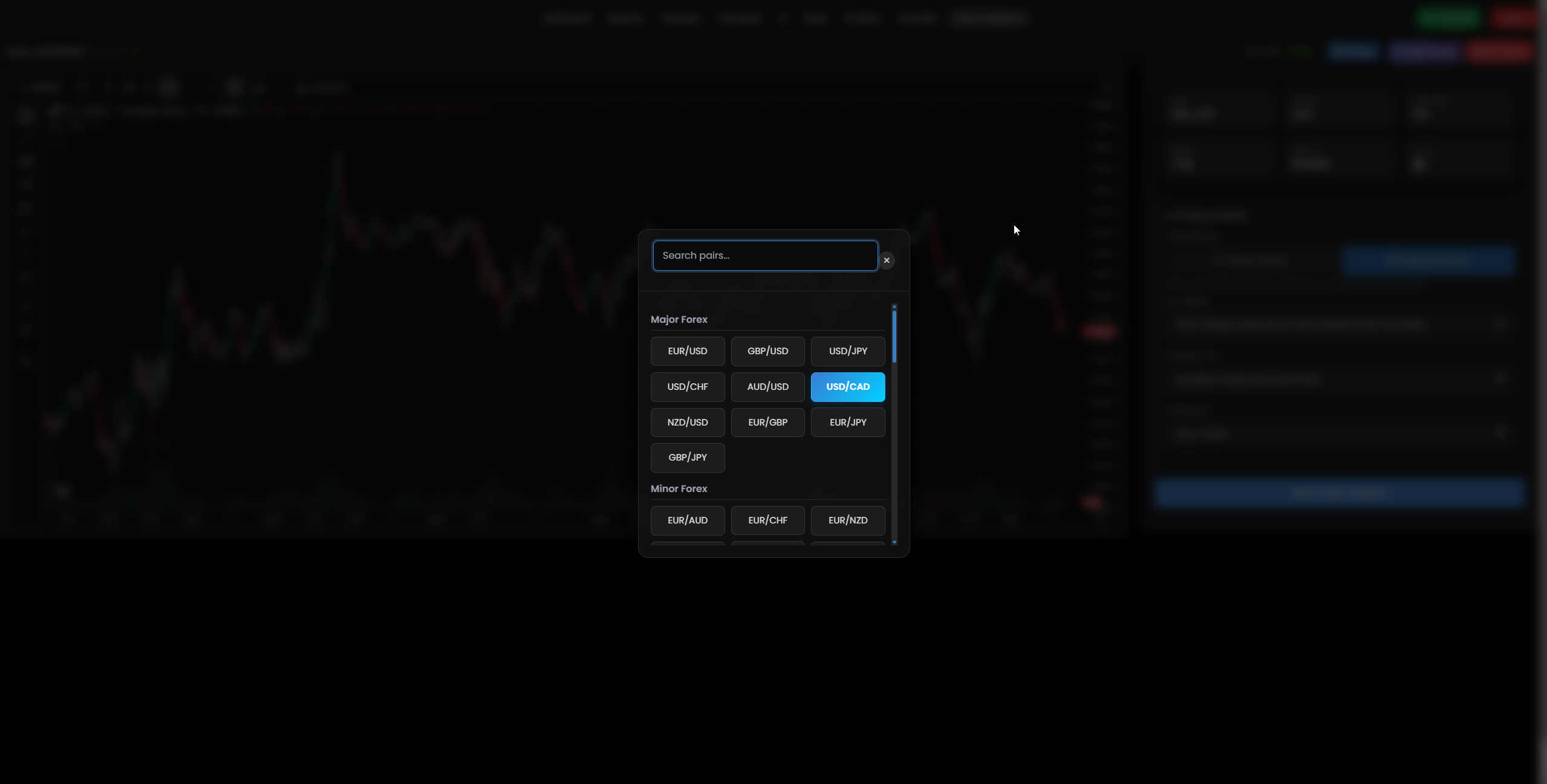

💱Currency Pair Selection Interface

Professional trading interface showing USD/CAD pair selection for the Liquidity Sweep Reversal strategy implementation

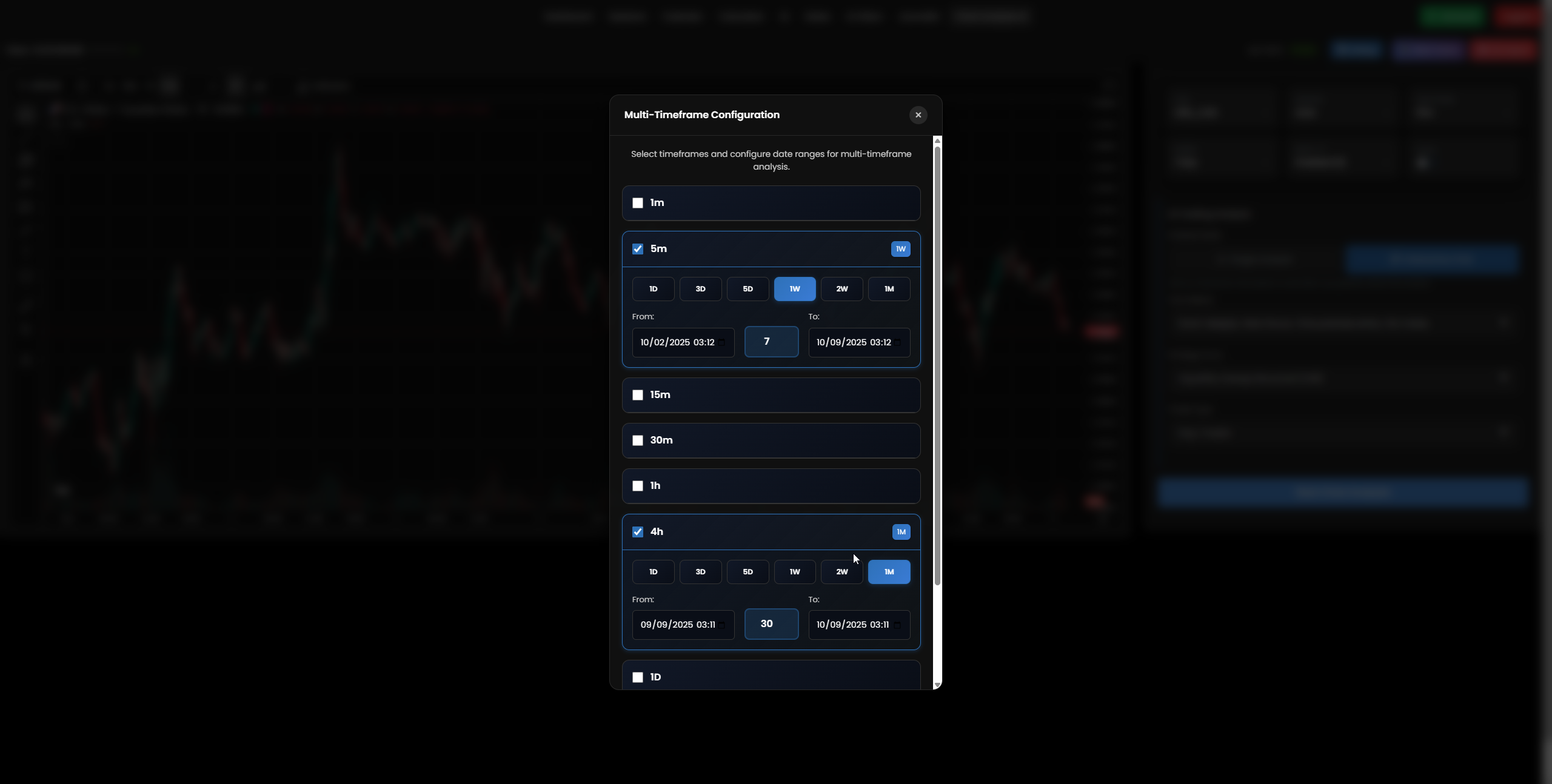

⏰Time Frame Analysis Interface

Multi-timeframe analysis interface displaying H4 and M5 charts for precise LSR entry timing and market structure analysis

📊Trading Results Interface

Live trading results showing the successful execution of the USD/CAD Liquidity Sweep Reversal strategy with profit metrics

🎥AI Tools Demonstration Video

Complete walkthrough of the AI-powered trading tools used for USD/CAD LSR analysis and execution

💡DETAILED MARKET ANALYSIS

H4 Timeframe Analysis: On the H4 timeframe, we observe a sustained upward movement indicating a strong bullish trend. However, the recent price action tells a different story. Candles 1498 (1.39358 - 1.39496) and 1497 (1.39323 - 1.39458) show aggressive buying pressure pushing price above previous highs, effectively sweeping liquidity positioned above those levels by retail traders. 📈

The subsequent H4 candles (1449, 1448, 1447) reveal weakening bullish momentum. Particularly noteworthy is candle 1447, which displays a relatively small body with a long upper wick - a classic sign of rejection at higher prices. This suggests institutional profit-taking and potential reversal setup. 🔄

M5 Precision Analysis: Drilling down to the M5 timeframe reveals the true institutional manipulation. The market pushed to highs of 1.39498 (candle 474) and 1.39508 (candle 422), creating perfect liquidity sweeps above prior swing highs. These moves triggered countless retail stop losses, providing the liquidity institutions needed. 🎯

Following these sweeps, we observe a series of M5 candles (413-400, and more recently 39-3) attempting to push higher but failing to sustain momentum. This is the hallmark of a liquidity sweep - price briefly breaks higher, then immediately loses steam as institutions begin their reversal. 📉

Entry Strategy: The SELL entry at 1.39450 targets a retest of the swept high for potential rejection. This level represents the perfect storm - retail traders who missed the initial move will likely buy here, providing more liquidity for our short position. The stop loss at 1.39550 sits above the highest point of the recent sweep, protecting against false breakouts while the take profit at 1.39250 targets the origin of the last significant M5 push, offering an excellent 1:2 risk-reward ratio. 💰

🧠 Trading Wisdom & Risk Management

🛡️ Professional Risk Management Rules:

- 💰 Position Sizing: Never risk more than 1-2% of your account per trade

- 🎯 Risk/Reward: Minimum 1:2 ratio, preferably 1:3 or better

- 📊 Correlation Awareness: Don't trade multiple CAD pairs simultaneously

- ⏰ Time Management: Set specific trading hours and stick to them

- 🧘 Emotional Control: Never trade when angry, stressed, or overconfident

Remember, trading is a marathon, not a sprint. 🏃♂️ Your emotional control is as crucial as your analytical skills. I've seen countless talented traders blow their accounts because they couldn't control their emotions. Focus on consistency and disciplined execution of your strategy - the profits will follow naturally.

Never chase trades! If you miss this setup, there will be another one tomorrow. Patience is the trader's greatest virtue. Wait for your setup to materialize perfectly, then execute with confidence. This disciplined approach separates professional traders from gamblers. 🎰➡️📈

Conclusion & Key Takeaways 🎓

🌟 Master Trader's Final Thoughts

The USD/CAD Liquidity Sweep Reversal strategy represents the pinnacle of institutional trading knowledge. By understanding how smart money operates, we can position ourselves alongside the market makers rather than against them. This isn't just about making money - it's about developing a professional mindset that will serve you throughout your trading career.

Key Success Factors: Master the art of patience, develop unwavering discipline, and always respect the market's power. The LSR strategy works because it's based on institutional behavior patterns that have existed for decades and will continue to exist as long as there are retail traders to provide liquidity. 🏦

Remember, every professional trader started as a beginner. The difference between those who succeed and those who fail isn't intelligence or luck - it's the willingness to learn, adapt, and maintain discipline even when emotions run high. Trade smart, trade safe, and let the market reward your patience. 🚀

Happy Trading! 📈💰

May your stops never get hit and your targets always be reached! 🎯