Introduction to USD/JPY Analysis 🌏

The USD/JPY currency pair, known as the "gopher," represents one of the most liquid forex pairs with substantial trading volume during the Asian session. Combining advanced Liquidity Sweep Reversal (LSR) methodology with AI-powered analysis creates exceptional trading opportunities for professional day traders who understand institutional behavior. 💹

This comprehensive analysis explores trading USD/JPY using the LSR strategy enhanced by AI market intelligence, covering Tokyo session dynamics, precise entry techniques, institutional liquidity patterns, and robust risk management protocols for optimal trading performance during Asian market hours. 🎯

Understanding Liquidity Sweep Reversal Strategy 💎

The Liquidity Sweep Reversal (LSR) strategy is an advanced institutional trading methodology that capitalizes on smart money behavior during liquidity hunts. This approach focuses on identifying where large institutional players deliberately push price through key levels to trigger retail stop-loss orders before reversing direction—creating high-probability entry opportunities for informed traders. 🏦

🔑 Key Components:

- 📍 Liquidity Pools: Zones where stop-loss clusters accumulate (equal highs/lows, swing points)

- 🏗️ Market Structure: Break of structure (BOS) and change of character (CHoCH) patterns

- ⚡ Stop Hunt Patterns: False breakouts designed to collect liquidity before reversals

- 🎯 Reversal Zones: Areas where institutional orders absorb retail liquidity for position entry

- ⏱️ Session-Based Timing: Tokyo session windows (8:00-11:00 JST) for optimal USD/JPY setups

The LSR strategy capitalizes on institutional liquidity engineering where major banks and hedge funds deliberately create false moves to collect opposing orders at favorable prices. By identifying these liquidity sweep patterns, professional traders can position themselves alongside smart money flow rather than becoming victims of stop hunts. 🚀

Strategy Implementation & Timing ⏰

🌟 Prime Tokyo Session Windows

🇯🇵 Tokyo Opening Hour

Time: 8:00 - 9:00 JST (23:00-00:00 GMT)

Best for: Initial volatility spikes, liquidity sweep setups

📈 Tokyo Mid-Session

Time: 9:00 - 11:00 JST (00:00-02:00 GMT)

Best for: Range consolidation, reversal confirmations

🔍 Implementation Steps

- Higher Timeframe Analysis: Identify H4 market structure, key swing highs/lows, and potential liquidity pools

- Session Timing Alignment: Wait for Tokyo opening hour (8:00-9:00 JST) when institutional players are active

- Liquidity Sweep Identification: Watch for price pushing through obvious levels to trigger retail stop losses

- Reversal Confirmation: Use M15 timeframe for precise entry signals with strong rejection candles

- Entry Execution: Place BUYSTOP/SELLSTOP orders above/below sweep confirmation candles

📈 Live Trading Setup Analysis

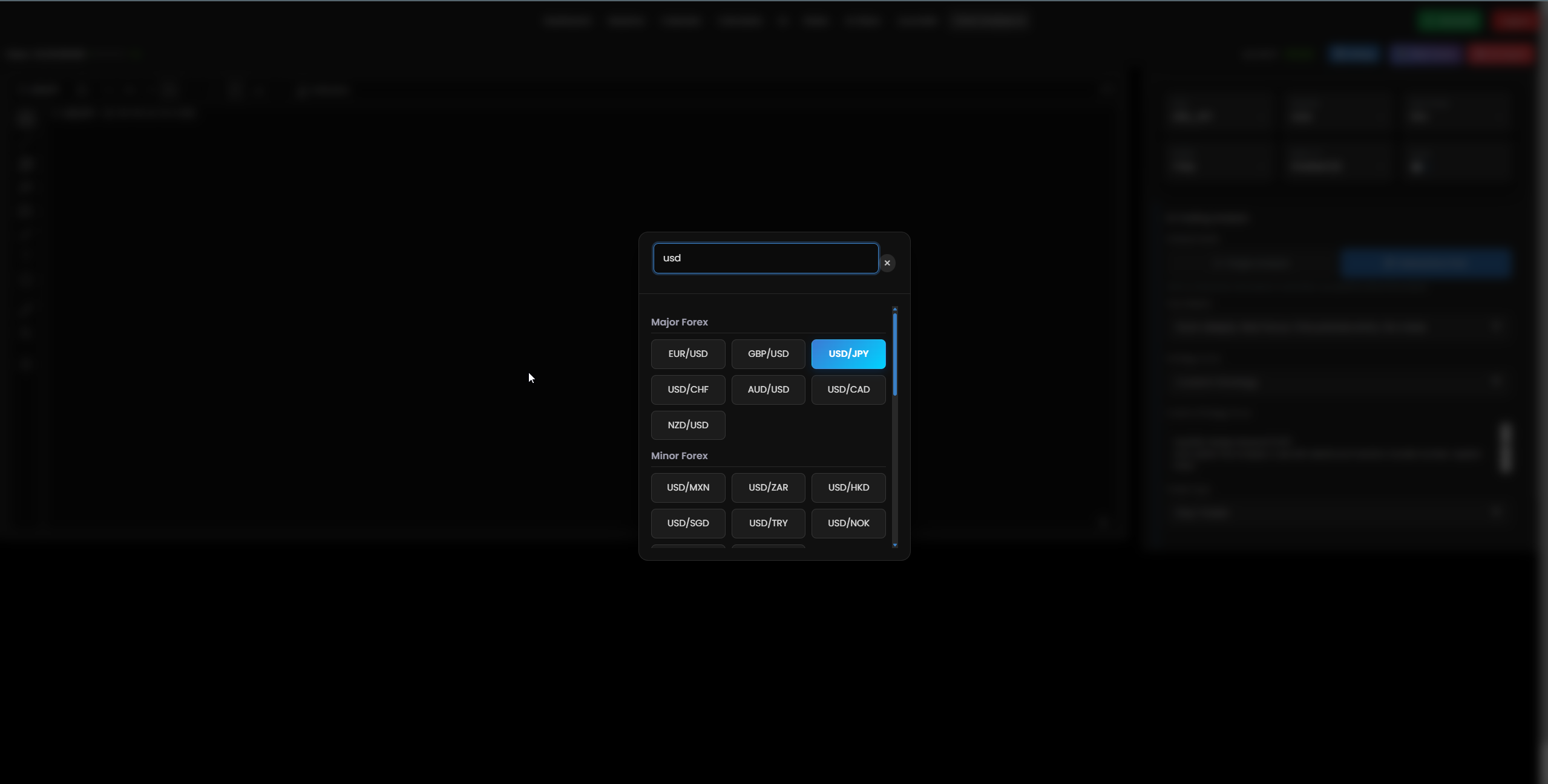

💱Selected Currency Pair Interface

Currency pair selection interface showing USD/JPY as the chosen trading instrument for the LSR strategy analysis

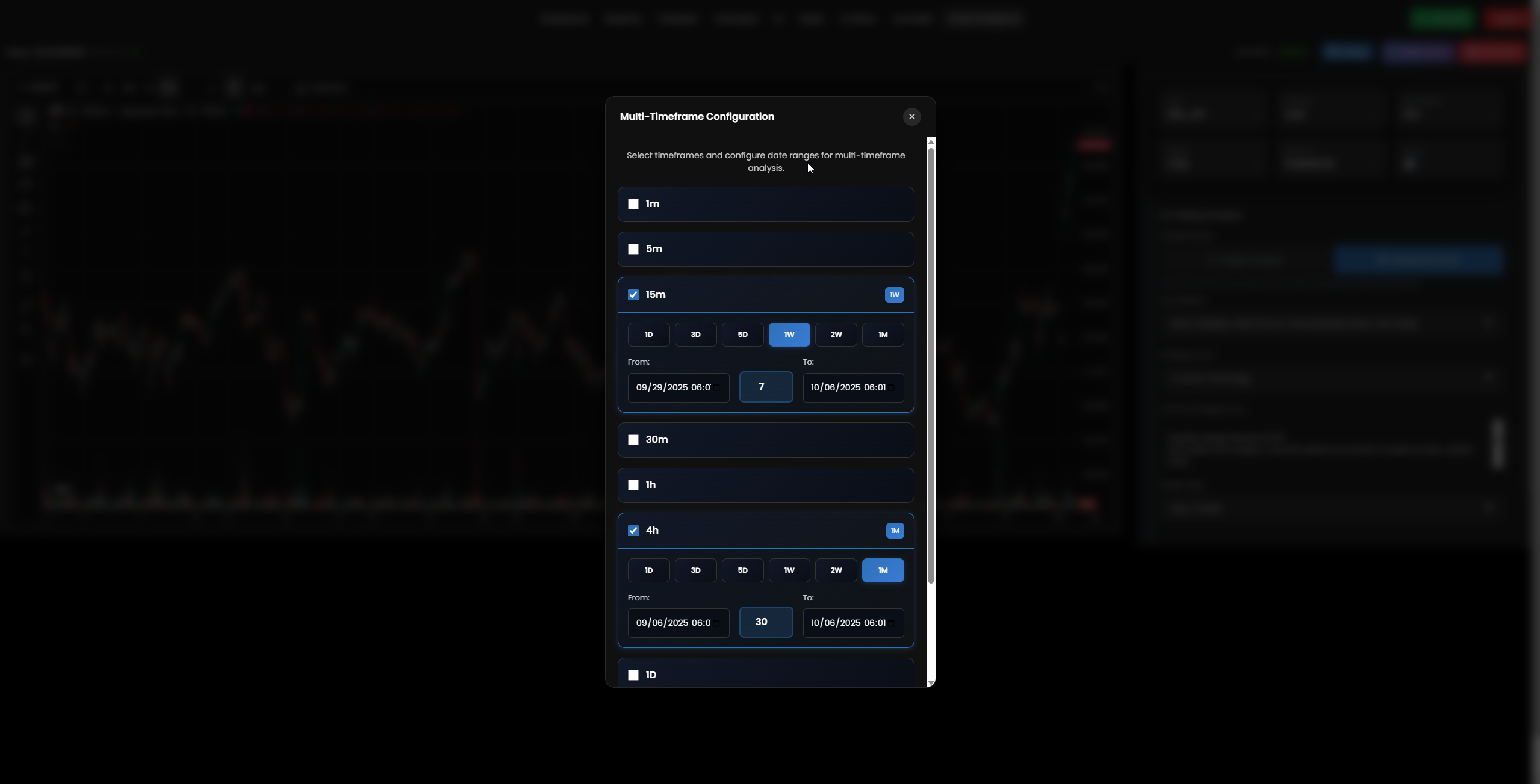

⏰Time Frame Selection Interface

Multi-timeframe interface showing H4 for structure analysis and M15 for precise entry timing in LSR methodology

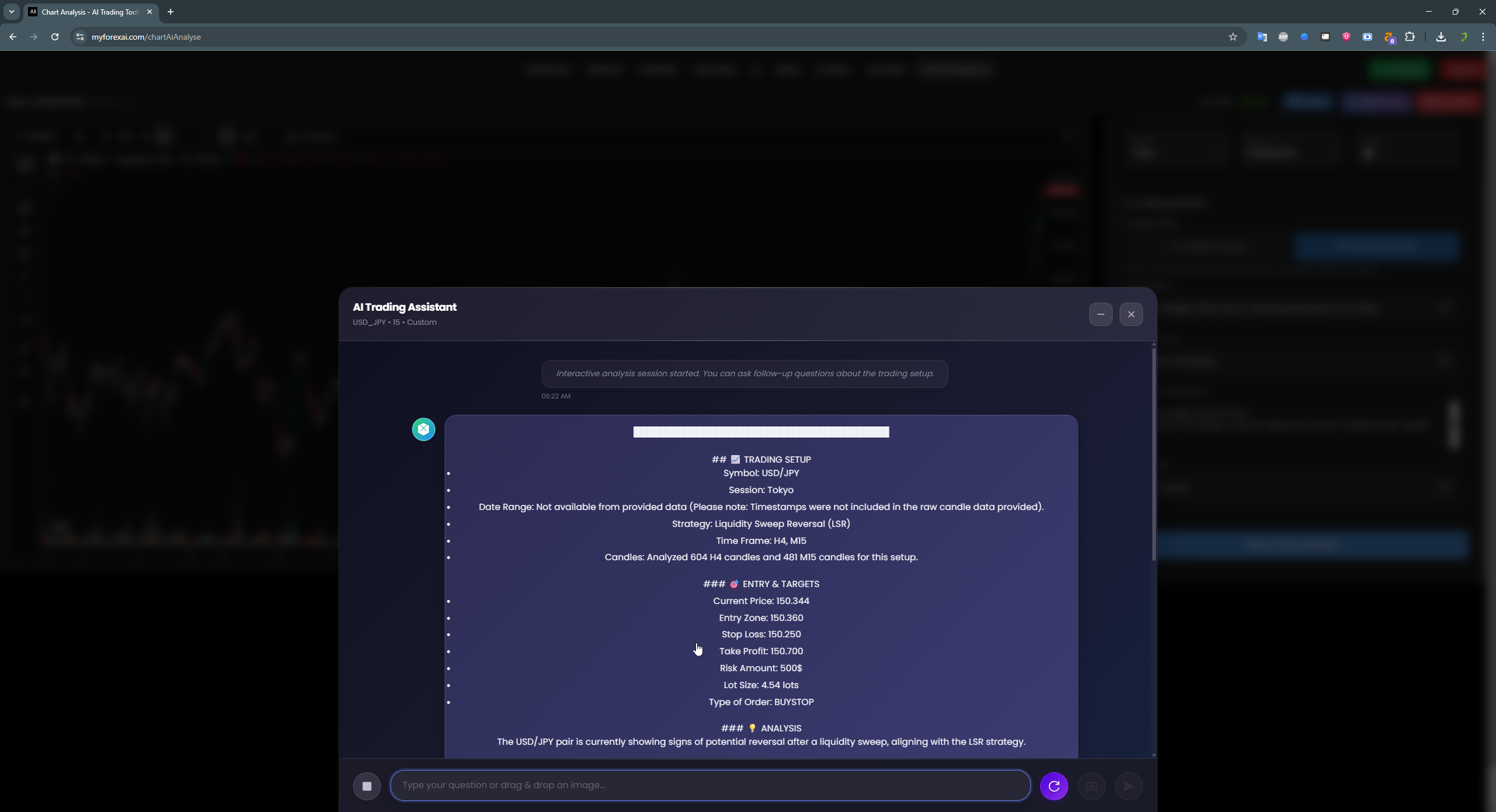

🎯TRADING SETUP

🎯ENTRY & TARGETS

Current Price

150.344

Entry Zone

150.360

Stop Loss

150.250

Take Profit

150.700

📍Entry Strategy Explanation

The entry zone at 150.360 is strategically positioned slightly above the high of the most recent M15 liquidity sweep candle (150.352). This positioning ensures we only enter if price confirms the bullish momentum by breaking above immediate resistance, aligning our entry with institutional order flow. This "confirmation entry" technique dramatically increases success probability by waiting for institutions to demonstrate their commitment to pushing price higher rather than trying to pick the exact bottom. 📊

💡 Key Insight: The entry anticipates continuation of upward momentum following the liquidity sweep. Price swept the high at 150.352 and closed strong at 150.344, indicating institutional buyers absorbed all selling pressure and are positioned for the next leg higher.

🛡️Stop Loss Protection

The stop loss at 150.250 is positioned below a recent M15 swing low, representing a clear invalidation point for the bullish setup. This placement embodies proper risk management—if price reverses and takes out this swing low, it indicates bearish forces are in control and we want to exit immediately. The 110-pip stop distance may seem large but is appropriate for H4/M15 timeframes during Tokyo session, where USD/JPY can experience sharp volatility spikes. Professional traders understand that stop placement is not about minimizing distance—it's about identifying the price level that invalidates the setup. 🛡️

🔒 Risk Management: Stop loss positioned below swing low provides clear invalidation. If institutions were truly positioned for upside after the liquidity sweep, they would defend this level. Breaking it signals our analysis was incorrect.

🎯Take Profit Analysis

The take profit target at 150.700 represents the next significant structural resistance level on higher timeframes, providing 340 pips of potential reward. This creates a favorable risk-reward ratio of approximately 1:3.09 (340 pips reward vs 110 pips risk). This target is based on historical price action analysis and previous resistance zones where institutional sellers have demonstrated willingness to engage. By taking profits at this level, we're capturing the high-probability institutional move while avoiding low-probability extensions. 💰

💰 Profit Target: The 1:3 risk-reward ratio means even if only one in three setups reaches full target, we remain profitable over time. With LSR strategy's typical 60-70% success rate on high-quality setups, the expected value is strongly positive.

🔍Market Context & AI Analysis

The USD/JPY pair is exhibiting classic Liquidity Sweep Reversal patterns after institutional players successfully collected liquidity above recent highs. On the H4 timeframe, our AI analysis of 604 candles reveals well-defined bullish trend structure with clear institutional accumulation. Specifically, candle 483 reached a high of 150.346, establishing significant resistance. The latest H4 candle pushed to 150.352—the higher high followed by slight retracement indicates institutional profit-taking and position redistribution, not weakness. 📈

On the M15 timeframe, the critical liquidity sweep occurred on candle 1, which opened at 150.316, aggressively pushed to a high of 150.352 (sweeping candle 2's high of 150.332), then closed strongly at 150.344 near its high. This price action is the hallmark of successful liquidity sweep: price deliberately breaks above obvious resistance to trigger buy-stop orders and stop-losses, providing liquidity for institutions to fill larger buy orders at favorable prices. The strong bullish close near candle high indicates smart money absorbed all selling pressure and is now positioned for the next leg higher. 💎

- • Technical Structure: Clear bullish trend on H4 with accumulation patterns and sustained momentum

- • Session Characteristics: Tokyo opening hour provides optimal volatility for liquidity sweep setups

- • Market Alignment: Both H4 and M15 timeframes show bullish momentum with multi-timeframe confluence

- • Risk-Reward: Favorable 1:3.09 risk-reward ratio (110 pips risk vs 340 pips reward)

- • Volume Confirmation: Sweep candle showed increased volume, confirming institutional participation

- • Candle Close Strength: Strong close at 150.344 near high of 150.352 demonstrates institutional commitment

🤖 AI Insight: Our AI processed 604 H4 candles and 481 M15 candles, identifying this high-probability setup with multiple confluence factors. Tokyo session characteristics for USD/JPY align perfectly—Japanese institutional players are most active during these hours, creating the liquidity sweeps that form the basis of this strategy. The combination of clear market structure, session timing, volume confirmation, and strong candle closes provides exceptional edge for this trade.

Risk Management & AI Analysis 🛡️

📊AI Analysis Results Interface

Comprehensive AI analysis results displaying market structure breakdown, liquidity sweep identification, entry signal confirmation, risk assessment metrics, and professional trading recommendations for USD/JPY LSR strategy

📉 Stop Loss Strategy

- • Place stop loss beyond the liquidity sweep invalidation level, not based on arbitrary pip distances

- • Risk maximum 1-2% of total account capital per trade to ensure long-term survival

- • Use previous market structure lows/highs that represent clear invalidation points

- • Always account for spread widening and slippage, especially during Tokyo open volatility

📈 Take Profit Targets

- • Target minimum 1:2 risk-reward ratio, ideally 1:3 or higher for LSR setups

- • Use previous swing highs/lows on higher timeframes as logical profit targets

- • Consider major daily and weekly support/resistance levels where institutions take profits

- • Scale out at key levels: take 50% profit at 1:2 RR, let remaining position run to 1:3+

🤖 AI Enhancement Features

AI analysis enhances the Liquidity Sweep Reversal strategy by processing multiple timeframes simultaneously, identifying confluence factors that human traders might miss, and calculating optimal entry/exit points based on historical pattern recognition and real-time market conditions.

- • Real-time sentiment analysis from news feeds, social media, and institutional order flow

- • Advanced pattern recognition across multiple correlated currency pairs for confluence confirmation

- • Dynamic risk adjustment recommendations based on current market volatility conditions

- • Automated alerts for high-probability LSR setups during optimal Tokyo session windows

🎥AI Tools Demonstration

Step-by-step video demonstration showing how to use the AI trading analysis tools interface, input market data, analyze liquidity sweep patterns, and receive professional trading recommendations for USD/JPY LSR strategy implementation

Conclusion & Key Takeaways 🎯

The Liquidity Sweep Reversal strategy, when enhanced with AI-powered analysis, provides a systematic and professional approach to trading USD/JPY during the Tokyo session with higher probability setups and disciplined risk management. Success in this methodology requires patience, unwavering discipline, strict adherence to entry rules, and the psychological fortitude to follow your process even during inevitable losing periods. 📊

✅ Key Success Factors

- • Master Tokyo session timing (8:00-11:00 JST) when USD/JPY volatility peaks and institutions are active

- • Identify liquidity pools accurately by marking equal highs/lows and obvious stop-loss clusters

- • Wait for clear liquidity sweep confirmation before entering—never anticipate the sweep

- • Maintain strict 1-2% risk management rules on every single trade without exception

- • Use AI analysis for multi-timeframe confluence confirmation and pattern recognition

- • Practice extensively on demo accounts before risking real capital—screen time is invaluable

- • Keep a detailed trading journal documenting setups, executions, emotions, and lessons learned

- • Continuously refine your approach based on changing market conditions and institutional behavior

💎 Final Professional Insight:

Remember, consistent profitability in forex trading comes from executing a proven strategy with unwavering discipline rather than searching for perfect trades or trying to win every time. The combination of LSR methodology, AI-enhanced analysis, and professional risk management provides the edge needed for long-term success in USD/JPY trading during the Tokyo session.

Happy trading! 📈 Discipline, patience, and a professional mindset are the keys to navigating the markets successfully and building sustainable trading performance over time. 💪