Introduction to GBP/USD 🚀

As a professional trader, I treat GBP/USD with a disciplined blend of structure, liquidity, and session timing. Today’s focus is a textbook Liquidity Sweep Reversal (LSR) setup on M15 with H4 context—ideal for catching a fresh rotation after a stop raid. Pair this with clear invalidation and defined objectives, and you get a mechanical, repeatable trade. ✅

We’re operating in the Tokyo session, a time known for liquidity grabs and measured movement. The play: allow the market to sweep short-term lows, confirm rejection, and then position for the BUY continuation toward nearby resistance. Let’s break it down 👇

My edge comes from consistency and sequencing, not prediction. For GBP/USD, I’m watching for a defined raid → rejection → continuation sequence on M15 while H4 provides the context. If the market fails to accept below the swept lows and prints a confident bullish close, I engage; if not, I wait. Patience is a position. 🧭

The LSR framework is mechanical: map liquidity, define invalidation, pre-plan objectives, and let a ruleset drive execution. This keeps decisions clean and repeatable—even when price moves quickly. 🔁

A final note on discipline: I don’t need to catch every move—only the ones that fit the plan. Missed setups are part of the business. What matters is process quality, not constant activity. 🎯

Understanding Liquidity Sweep Reversal (LSR) 💡

LSR hunts clustered stops around recent extremes. When price sweeps below local lows and then rejects decisively, it signals trapped sellers and a potential rotation higher. The key is HTF alignment: use H4 to define range and bias, then execute on M15 once acceptance fails below the swept zone. 🏦

🔑 Key Components:

- 📍 Liquidity Pools: Lows around 1.34456 attracting sell-side stops

- 🏗️ Market Structure: H4 consolidation with recent pullback; M15 sweep and rejection

- ⚡ Imbalances: Post-sweep inefficiencies likely to be retraced

- 🎯 Order Blocks: Bullish rejection blocks forming after the sweep

- ⏱️ Timing: Tokyo session consolidation → raid → reversal

A valid LSR requires failure to accept the raid: bodies closing back inside range, displacement toward inefficiencies, and continuation away from the swept zone. Entries become low-drama when you wait for those elements to align. 🧠

⚠️ Common Pitfalls

- Clicking during the sweep rather than on confirmed rejection

- Ignoring H4 context and trading against the dominant narrative

- Stops placed inside noise instead of beyond invalidation

- Chasing candles without mapped targets and management plan

Strengthen your execution by journaling each LSR taken: screenshot the raid, the rejection candle, displacement, and the management decisions. Over 20+ samples, patterns emerge that sharpen timing and confidence. 📝

Strategy Implementation & Timing ⏰

🌟 Prime LSR Conditions

H4 Context

Range between 1.34229 and 1.34868

Bias: Bullish after sweep and rejection

M15 Execution

Liquidity raid below 1.34456 → strong bullish close at 1.34482

Enter on confirmation; manage invalidation decisively

- • Current Price: 1.34482

- • Entry Zone: 1.34482

- • Stop Loss: 1.34440

- • Take Profit: 1.34586

- • Risk Amount: $500

- • Lot Size: 11.90 lots

- • R:R Profile: Favorable short-term continuation

- • Execution: Confirmation on M15 rejection and bullish close

🧪 Validation & Management

Validation comes from closing behavior, rejection at lows, and displacement away from the sweep. Manage with partials into inefficiencies and logical highs, then trail behind structure. If the market reclaims below the swept lows and holds, step aside—discipline preserves edge. 🛡️

Alternative path: a second sweep followed by a stronger rejection. Waiting for the second failure to accept often produces cleaner continuation and improved R:R. Patience compounds edge. ⏳

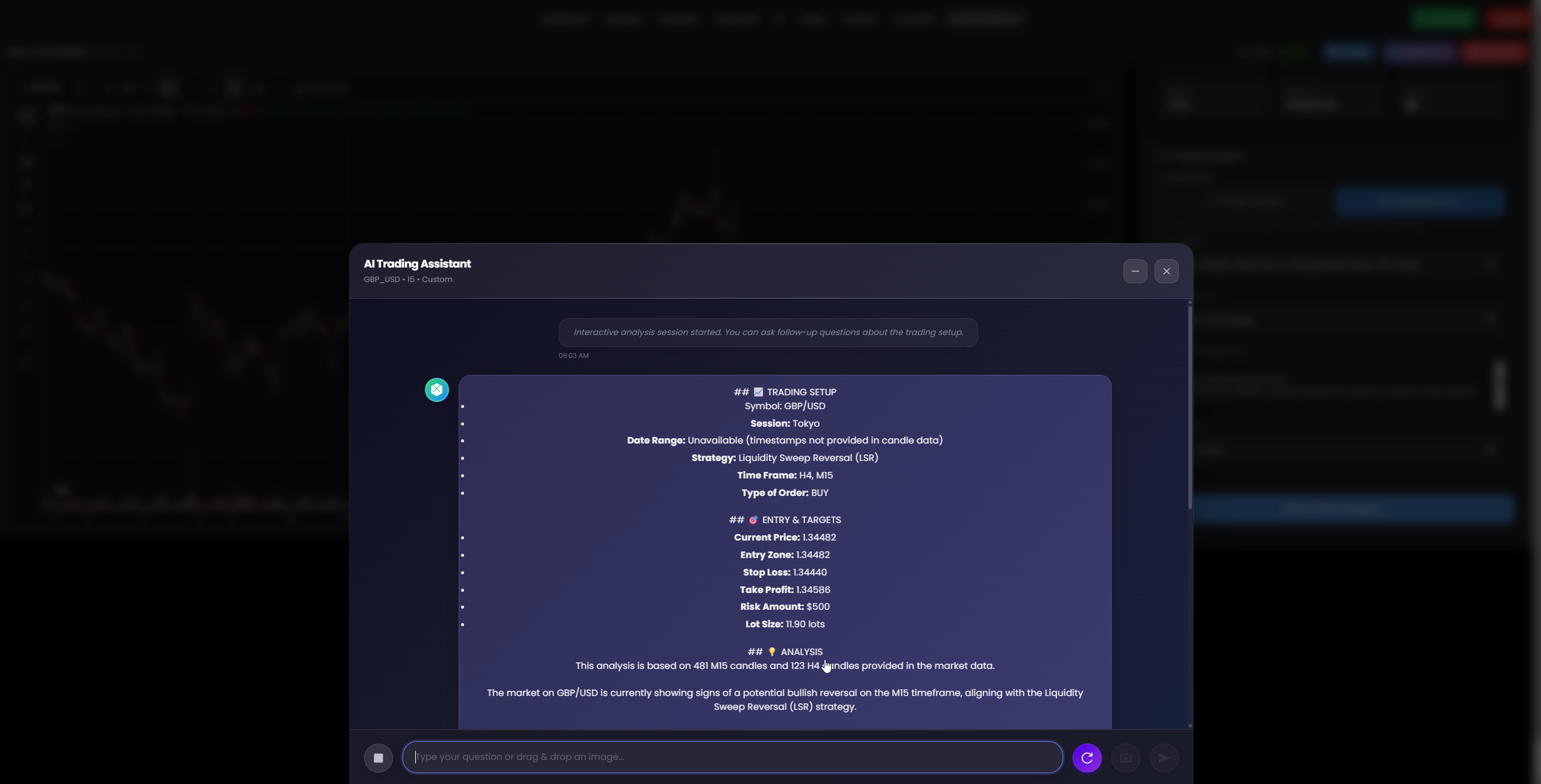

📈 Live Trading Setup Analysis

On H4, Cable is consolidating after a measured pullback, with range boundaries around 1.34229 and 1.34868. The M15 sweep below 1.34456 triggered rejection; most recent candle closed bullish at the high 1.34482, signaling intent to rotate higher toward 1.34586. ✅

Entry at 1.34482 is justified by failure to accept below the raid, clean displacement, and alignment with HTF bias. Stops are placed outside noise at 1.34440; targets stair-step through inefficiency fills and near-term highs. Keep execution mechanical and let the ruleset drive progression. 🧩

If price pauses near 1.34540–1.34586, consider partials and protect with a structural trail. If momentum extends, let the runner breathe; if it fades, secure gains and re-assess. Consistency > hero trades. 🕊️

This analysis leverages 481 M15 and 123 H4 candles. On H4, price is consolidating after a prior push higher and a measured pullback—range boundaries around 1.34229 (support) and 1.34868 (resistance). Within this context, recent M15 price action swept liquidity below the 1.34456 low (Candle 4), then immediately rejected. The most recent candle, TFM15 Candle 1 [134470,134482,134464,134482], closed bullish at its high 1.34482, signaling strong rejection and potential continuation. ✅

The entry aligns with the BUY thesis at 1.34482, with Stop Loss 1.34440 placed safely below the swept lows to allow natural noise. First objective is 1.34586 (M15 Candle 6 high), a short-term resistance pocket and logical liquidity resting area. The trade is mechanical: if price reclaims below the swept lows and fails to hold the bullish close, we invalidate; otherwise, we let the move mature into the objective. 🔧

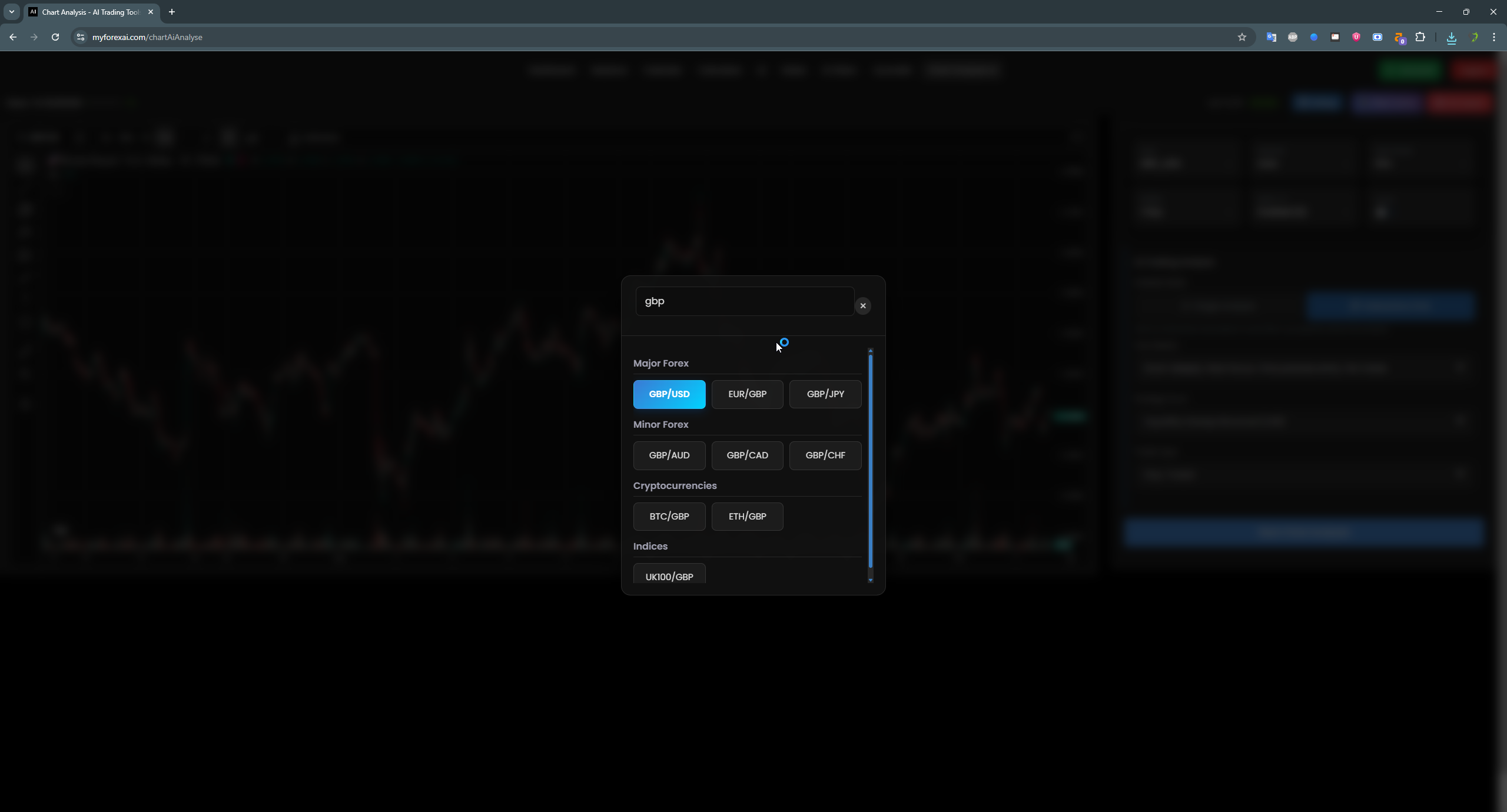

💱Selected Pair Interface

GBP/USD selection interface contextualizing instrument choice

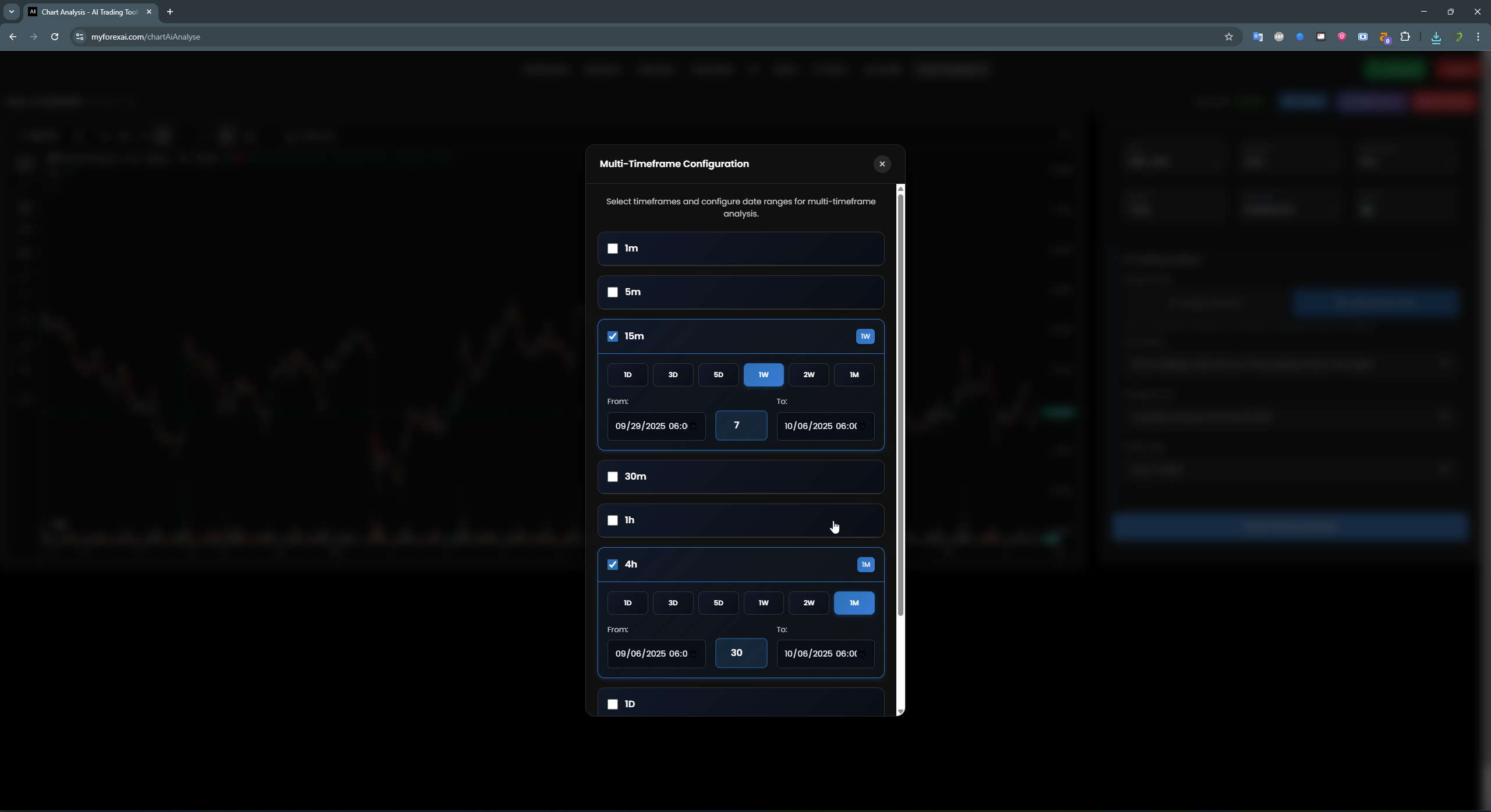

⏰Time Frame Selection Interface

M15 execution timeframe optimized for LSR confirmation

📊Results Interface

Outcome interface showcasing rejection and target progression

AI Tools Demonstration Video

Risk Management & AI Analysis 🛡️

I size for a fixed $500 risk with 11.90 lots based on the current volatility and stop distance. Invalidation sits below 1.34440. AI tools monitor imbalances, order flow velocity, and session behavior to confirm continuation toward 1.34586. If momentum stalls or acceptance forms below the swept zone, I exit decisively and reassess. 📏

Trader's Wisdom: Trading blends analysis, execution, and mindset. Stay disciplined, never over-risk, and let the setup work for you. Even high-quality trades can lose—consistency comes from risk control and process. 🧘♂️📊

Conclusion & Key Takeaways ✅

The GBP/USD LSR setup is straightforward: sweep below 1.34456, reject with a strong M15 bullish close at 1.34482, then target 1.34586. Execute with precision, respect invalidation at 1.34440, and let the math do the heavy lifting. For more institutional-grade setups and AI-assisted insights, explore our AI Day Trader Analyse series. 📚🔍