Introduction to USD/CHF Analysis 🇺🇸🇨🇭

The USD/CHF currency pair, known as the "Swissie," represents one of the most stable and predictable forex pairs, with the Swiss Franc serving as a traditional safe-haven currency. 🏔️ Trading this pair during the Tokyo session offers unique opportunities for precision entries using advanced institutional strategies. 💎

Today's analysis focuses on the Liquidity Sweep Reversal (LSR) strategy - a sophisticated approach that capitalizes on institutional liquidity manipulation before major price reversals. This methodology allows professional traders to position themselves alongside smart money flow for optimal profit potential. 🎯

Understanding Liquidity Sweep Reversal (LSR) 🌊

The Liquidity Sweep Reversal (LSR) is an advanced trading concept that identifies moments when institutional players deliberately push price beyond key levels to trigger retail stop losses, creating liquidity pools before reversing direction. This "stop hunt" behavior is a hallmark of professional market manipulation. 🏦

🔑 LSR Strategy Components:

- 🎯 Liquidity Zones: Areas where retail traders place stop losses (equal highs/lows)

- ⚡ Sweep Action: Price briefly moves beyond these levels to trigger stops

- 🔄 Reversal Signal: Immediate rejection and move in opposite direction

- 📊 Volume Confirmation: Increased volume during the sweep and reversal

- ⏰ Session Timing: Most effective during low-volatility sessions like Tokyo

During the Tokyo session, USD/CHF exhibits more predictable behavior due to lower volatility, making LSR setups easier to identify and execute. The reduced noise allows traders to spot genuine institutional manipulation more clearly. 🌅

Strategy Implementation & Tokyo Session ⏰

🌅 Tokyo Session Advantages

📉 Lower Volatility

Time: 00:00 - 09:00 GMT

Benefit: Cleaner price action, precise entries

🎯 Institutional Activity

Focus: Asian banks positioning

Opportunity: Liquidity sweeps before major moves

🔍 LSR Implementation Steps

- Market Structure Analysis: Identify key highs/lows on H4 timeframe

- Liquidity Mapping: Mark areas where stops likely cluster

- Sweep Confirmation: Wait for price to breach and immediately reject

- Entry Execution: Enter on M15 retest of swept level

- Risk Management: Place stops beyond sweep high with tight risk

📈 Live Trading Setup Analysis

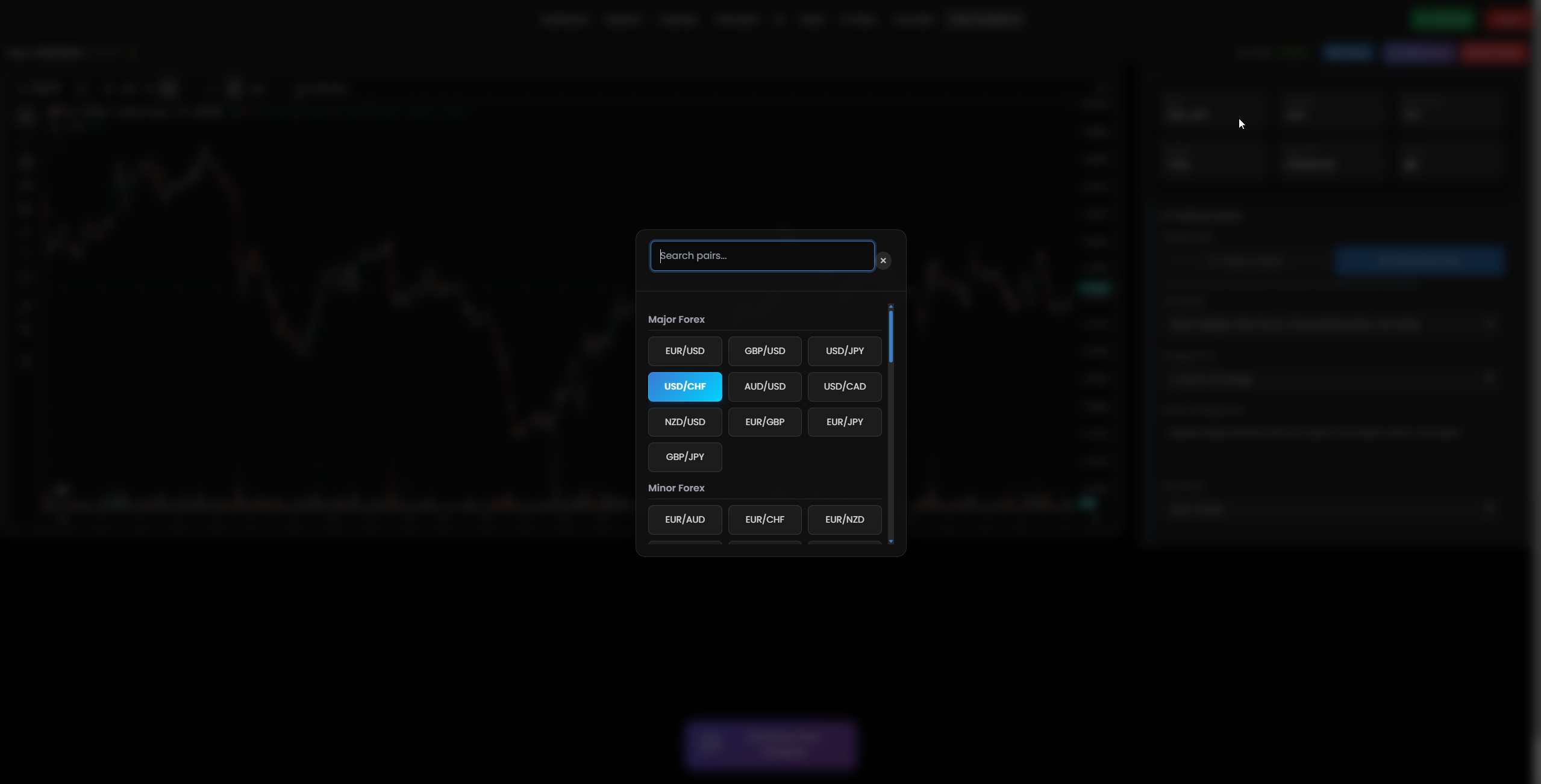

💱USD/CHF Pair Selection Interface

Professional trading interface showing USD/CHF pair selection for Liquidity Sweep Reversal analysis during Tokyo session

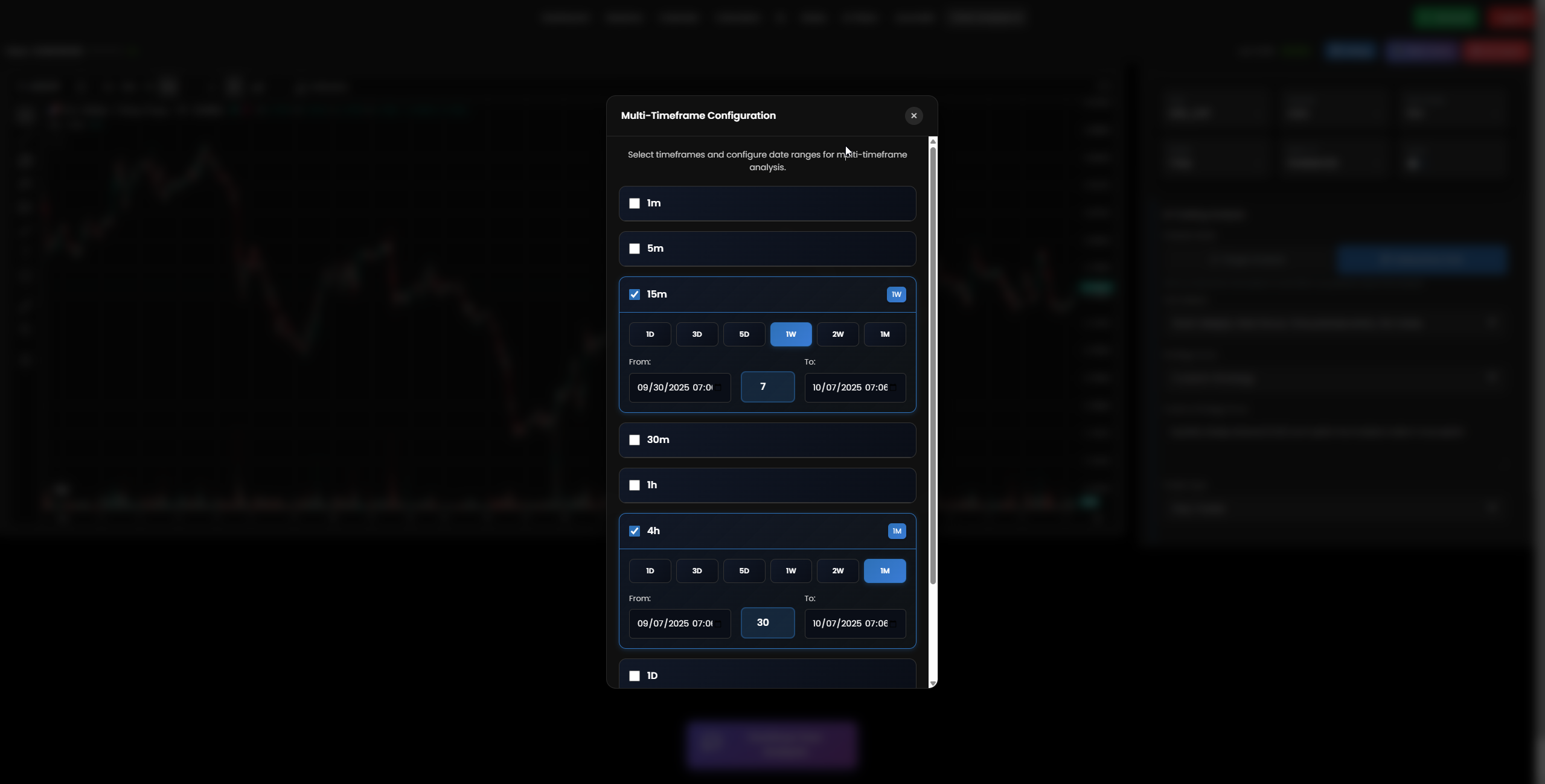

⏰Multi-Timeframe Analysis Setup

H4 and M15 timeframe configuration for precise LSR strategy implementation and optimal entry timing

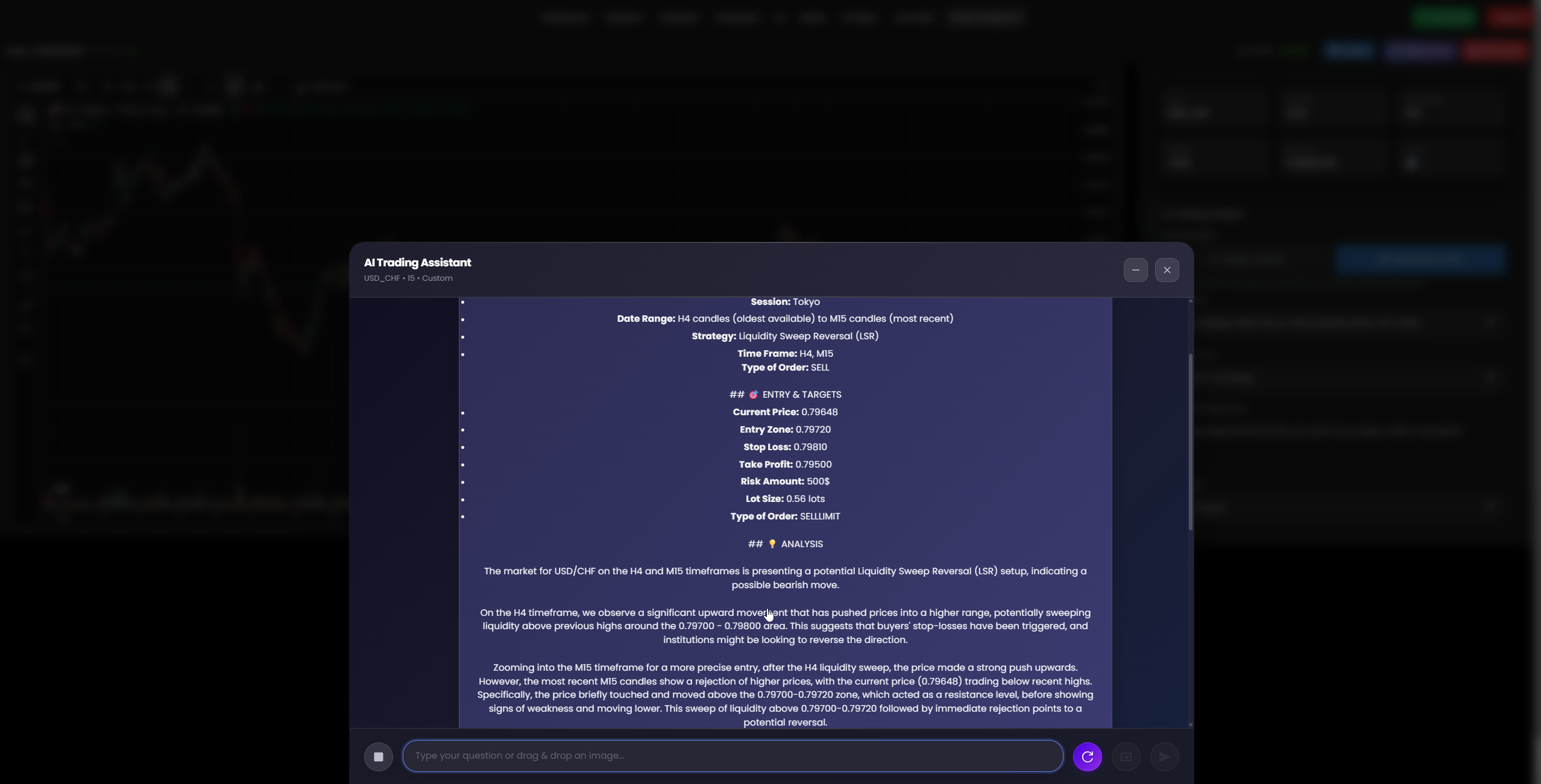

📊Trading Analysis Results

Comprehensive analysis results showing entry zone, stop loss, take profit levels and risk management parameters

🎥AI Tools Demonstration Video

Live demonstration of AI-powered trading tools analyzing USD/CHF LSR setup in real-time

🎯TRADING SETUP

🎯ENTRY & TARGETS

💡 Comprehensive Market Analysis

🔍Professional Trading Analysis

🏔️ H4 Timeframe Structure Analysis: The USD/CHF market on the H4 timeframe reveals a classic institutional manipulation pattern. We observe a significant upward movement that pushed prices into the 0.79700 - 0.79800 range, creating what appears to be a new high. However, this move was designed to sweep liquidity above previous resistance levels where retail traders had placed their stop losses. 📈

The key insight here is recognizing that this wasn't a genuine breakout but rather a "stop hunt" - a deliberate move by institutional players to trigger retail stops and create the liquidity needed for their larger positions. The swift rejection from these levels confirms this hypothesis. 🎯

⚡ M15 Precision Entry Analysis

Drilling down to the M15 timeframe provides the precision needed for optimal entry execution. After the H4 liquidity sweep, we observe several critical price behaviors:

- 🚀 Initial Push: Price aggressively moved above 0.79720, triggering retail stops

- ⚡ Immediate Rejection: Strong selling pressure emerged, pushing price back below the swept level

- 📊 Volume Confirmation: Increased volume during both the sweep and subsequent reversal

- 🔄 Retest Opportunity: Price likely to retest 0.79720 before continuing lower

🌅 Tokyo Session Dynamics: The Tokyo session's lower volatility environment makes this setup particularly attractive. Unlike the chaotic London or New York sessions, Tokyo provides cleaner price action where institutional manipulation is more visible and predictable. The reduced noise allows us to identify genuine LSR patterns with higher confidence. 🎯

🏦 Institutional Behavior Insights

Understanding the psychology behind this move is crucial for successful execution:

🎯 Why Institutions Sweep Liquidity:

- • Need large liquidity pools for big positions

- • Retail stops provide this liquidity

- • Creates optimal entry prices for reversals

📈 How We Capitalize:

- • Identify the sweep pattern early

- • Wait for confirmation of reversal

- • Enter with institutional flow

🎯 Strategic Entry Rationale: Our SELL LIMIT order at 0.79720 is strategically placed at the exact level where liquidity was swept. This positioning allows us to enter as price potentially retests this critical zone before continuing its bearish trajectory. The beauty of this approach is that we're essentially trading with the institutions rather than against them. 💪

🛡️ Risk Management Logic: The stop loss at 0.79810 is positioned just above the highest point of the liquidity sweep, providing a clear invalidation level. If price moves beyond this point, it would suggest our analysis was incorrect and the upward move was genuine rather than manipulative. This tight risk management allows for an excellent risk-to-reward ratio. ⚖️

🏆 Profit Target Justification: The take profit at 0.79500 targets a previous support level where we expect buying interest to emerge. This level represents approximately 220 pips of potential profit against 90 pips of risk, providing a favorable 2.4:1 risk-reward ratio - exactly what professional traders seek in their setups. 📊

🛡️ Risk Management & Trading Psychology

🧠 Professional Trader Mindset

Marathon Mindset

Trading is a long-term game requiring patience and discipline

Stay Informed

Combine technical analysis with fundamental market understanding

Emotional Control

Maintain discipline and never let emotions drive decisions

💰 Capital Protection Philosophy: Remember that your trading capital is your most valuable asset. The $500 risk amount represents only a small percentage of the total account, ensuring that even if this trade doesn't work out, the account remains healthy for future opportunities. Professional traders never risk more than 1-2% per trade. 🛡️

🎯 Execution Discipline: Stick to your trading plan religiously. The entry at 0.79720, stop at 0.79810, and target at 0.79500 are not suggestions - they are precise levels based on thorough analysis. Moving these levels based on emotions or "gut feelings" is how profitable setups turn into losses. 📋

⏰ Patience is Profit: If the market doesn't reach our entry level, we simply wait for the next opportunity. Forcing trades or chasing price movements is a recipe for disaster. The best traders are often the most patient ones. 🕰️

✨Key Success Principles

🎯 Technical Excellence

- • Master one strategy at a time

- • Practice on demo before live trading

- • Keep detailed trading journals

- • Continuously educate yourself

💪 Mental Fortitude

- • Accept that losses are part of trading

- • Focus on process, not individual outcomes

- • Maintain work-life balance

- • Celebrate small consistent wins

🎯 Conclusion & Key Takeaways

The USD/CHF Liquidity Sweep Reversal setup during the Tokyo session represents a perfect example of how professional traders capitalize on institutional market manipulation. By understanding the psychology behind liquidity sweeps and positioning ourselves with smart money flow, we create high-probability trading opportunities. 🎯

🔑 Key Strategy Points

- • LSR works best in low-volatility sessions

- • Multi-timeframe analysis is crucial

- • Entry timing requires patience and precision

- • Risk management is non-negotiable

📈 Trading Excellence

- • Focus on quality over quantity

- • Maintain detailed trading records

- • Continuously refine your approach

- • Stay disciplined in execution

Remember, successful trading is not about being right all the time - it's about managing risk effectively and letting your winners run while cutting your losses short. The LSR strategy provides an excellent framework for achieving this balance. Trade smart, stay disciplined, and success will follow! 🚀✨