Introduction to BTC/USD Analysis ₿

The BTC/USD cryptocurrency pair represents the world's most valuable digital asset paired with the US Dollar, commanding over $500 billion in market capitalization and exceptional volatility opportunities. Combining advanced Liquidity Sweep Reversal (LSR) methodology with AI analysis creates powerful trading setups for crypto day traders. 🚀

This comprehensive analysis explores trading BTC/USD using the LSR strategy enhanced by AI-powered market insights, covering Tokyo session timing, precise entry techniques, and advanced risk management for optimal cryptocurrency trading performance. 🎯

Understanding LSR Strategy 🔄

The Liquidity Sweep Reversal (LSR) strategy is a sophisticated methodology that capitalizes on institutional liquidity manipulation in cryptocurrency markets, particularly effective during Tokyo session when Asian institutional traders create significant price movements. ⏰

🔑 Key LSR Components:

- 💧 Liquidity Pools: Areas where retail stop losses cluster (recent highs/lows)

- 🌊 Sweep Mechanics: Price moves to trigger stops before reversing

- ⚡ Reversal Signals: Immediate rejection after liquidity sweep

- 🎯 Entry Zones: Optimal positioning after sweep completion

- ⏱️ Session Timing: Tokyo session for maximum effectiveness

The strategy exploits whale behavior patterns where large cryptocurrency holders create false breakouts to accumulate positions at better prices, allowing smart traders to position with institutional flow. 🐋

Strategy Implementation & Timing ⏰

🌟 Prime LSR Windows

🇯🇵 Tokyo Session

Time: 00:00 - 09:00 GMT

Best for: Asian institutional flows, lower volatility sweeps

🌅 Early London

Time: 07:00 - 10:00 GMT

Best for: European entry, overlap opportunities

🔍 Implementation Steps

- Market Analysis: Identify H4 structure and recent swing highs/lows

- Session Timing: Focus on Tokyo session for optimal LSR setups

- Sweep Identification: Watch for price pushing above/below key levels

- Reversal Confirmation: Use M5 timeframe for precise entry signals

📈 Live Trading Setup Analysis

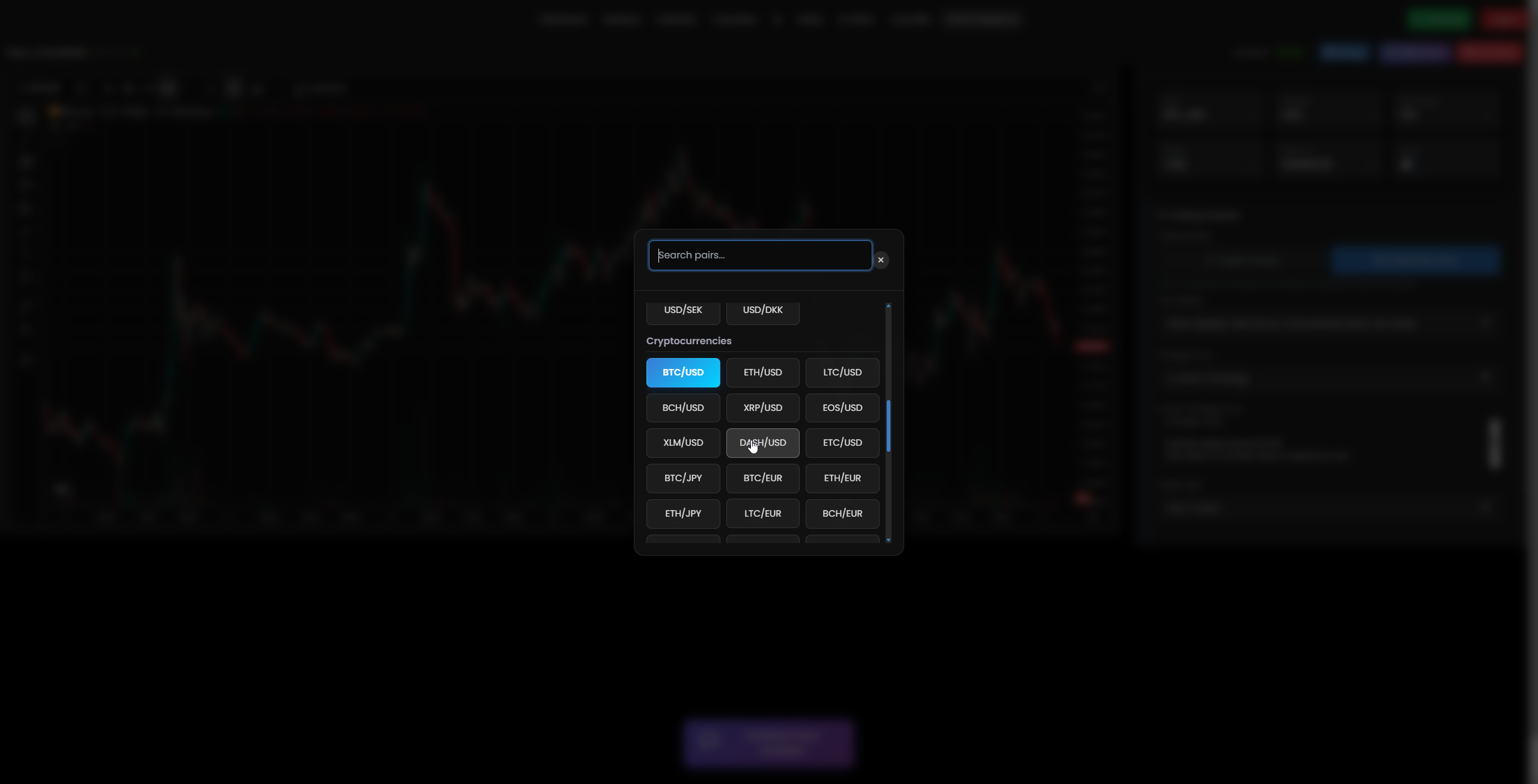

₿Selected Currency Pair Interface

Currency pair selection interface showing BTC/USD as the chosen cryptocurrency instrument for the LSR strategy analysis

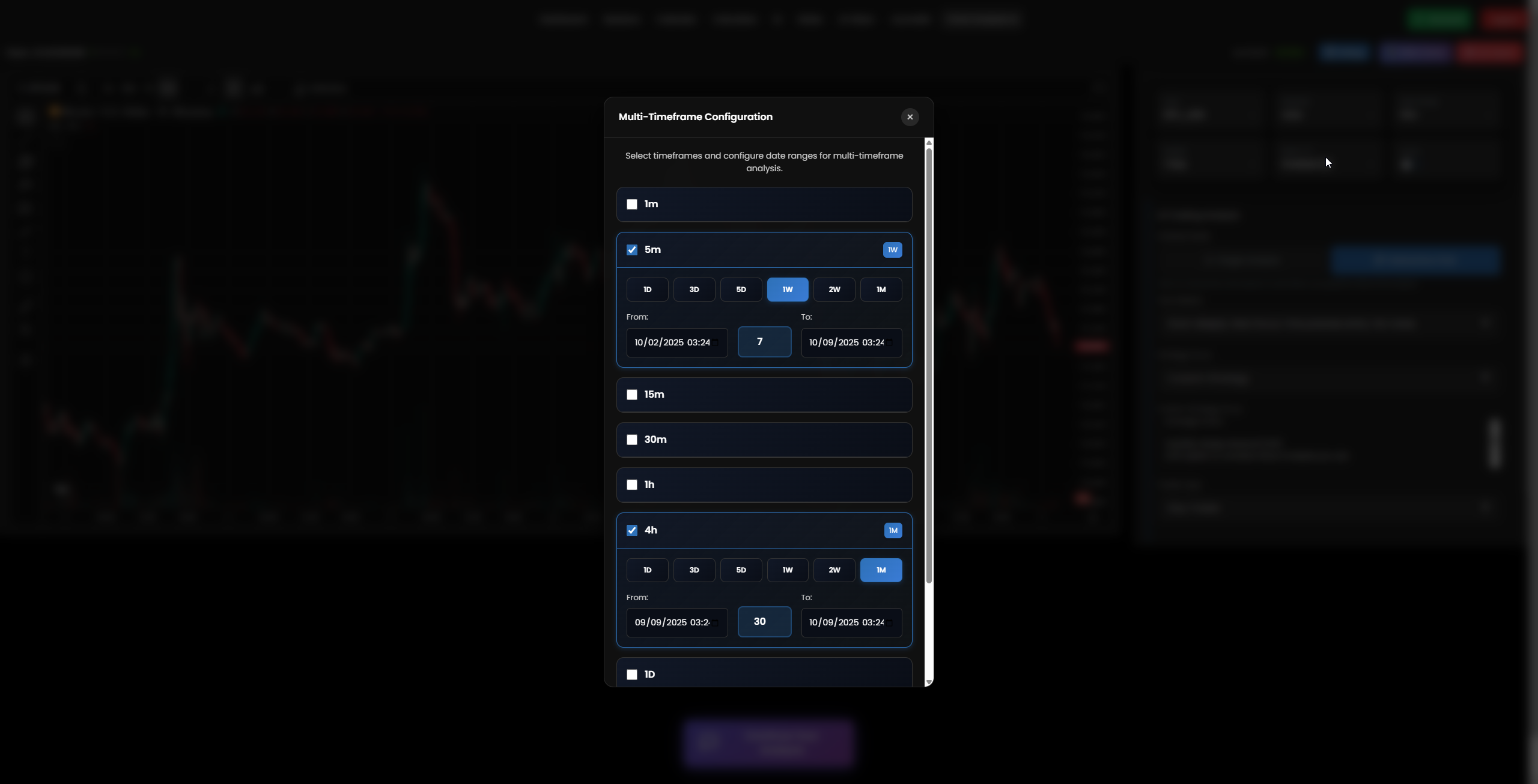

⏰Time Frame Selection Interface

Multi-timeframe selection interface optimized for LSR strategy implementation with H4 structure and M5 precision entries

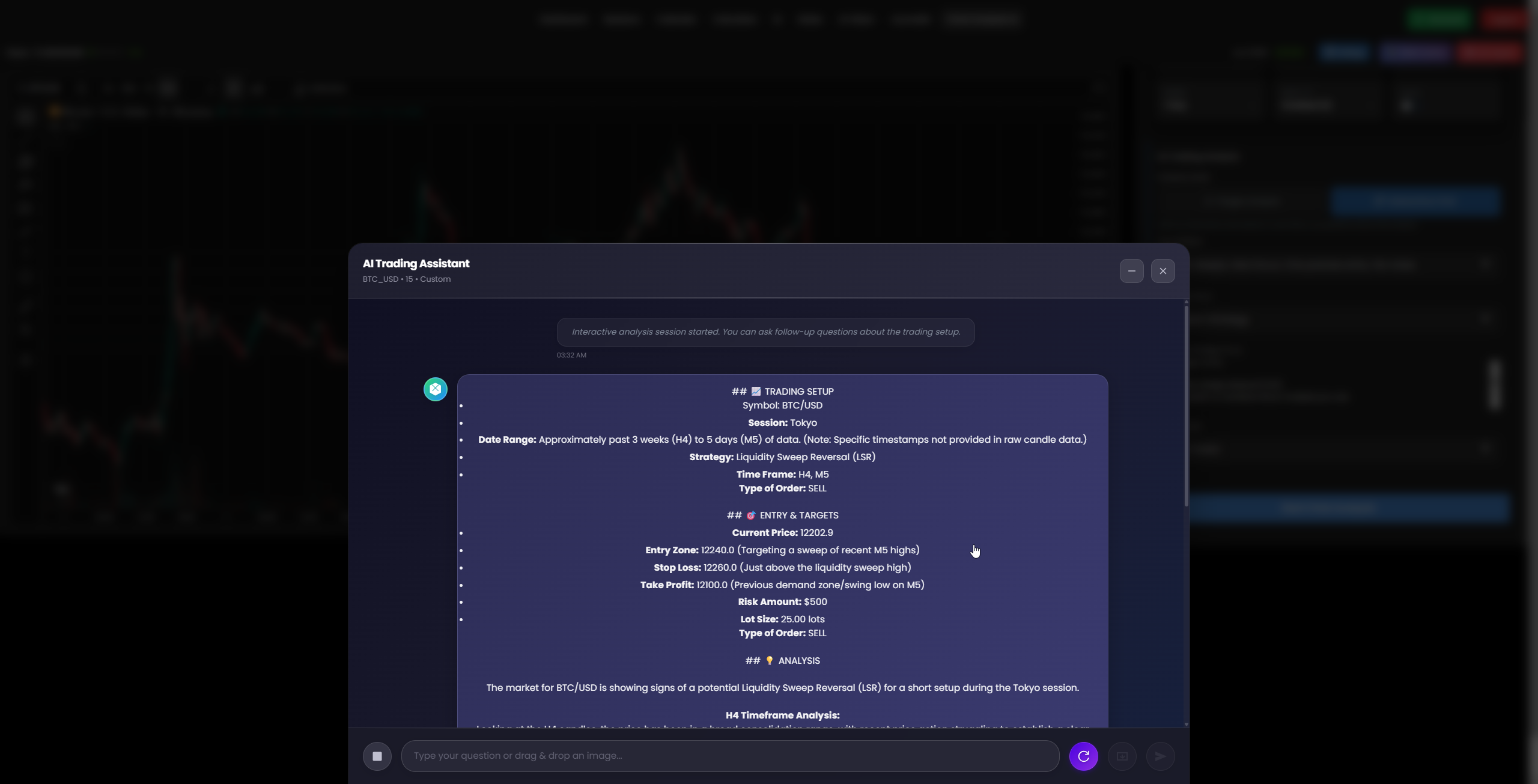

📊Trading Results Interface

Real-time trading results interface displaying BTC/USD LSR strategy performance metrics and trade outcomes

🎥AI Tools Demonstration Video

Live demonstration of AI-powered tools analyzing BTC/USD LSR setups in real-time trading conditions

🎯TRADING SETUP

🎯ENTRY & TARGETS

💡 Comprehensive Market Analysis

🔍 Detailed LSR Analysis:

The BTC/USD market is exhibiting classic Liquidity Sweep Reversal (LSR) characteristics during the Tokyo session, presenting an exceptional short opportunity. This setup demonstrates how institutional players manipulate retail sentiment before establishing their true directional bias. 🎭

📊H4 Timeframe Analysis

Examining the H4 candles reveals BTC/USD trapped in a broad consolidation range with significant resistance around $12,550-$12,600. This level has consistently rejected bullish attempts, creating a strong ceiling for price action. 🏗️

Recent H4 structure shows lower highs formation, indicating underlying bearish pressure despite multiple bullish attempts. The market structure suggests institutional distribution at higher levels, with smart money preparing for a significant downward move. 📉

The most recent H4 candles display indecision patterns and bearish momentum following upward pushes, confirming exhaustion from buyers and potential reversal conditions. This creates the perfect environment for LSR strategy implementation. ⚡

🔬M5 Timeframe LSR Setup Analysis

The M5 timeframe reveals the liquidity sweep mechanics in perfect detail. Price recently pushed above local swing highs around $12,213.5 and $12,235.0, effectively sweeping retail stop losses and trapping late buyers at unfavorable prices. 🪤

This upward sweep represents classic institutional manipulation - creating false breakout signals to accumulate short positions at premium prices. The current price at $12,202.9 shows immediate rejection after the liquidity grab, confirming the reversal setup. 🔄

Candle #1 (most recent) closed significantly lower than its open, forming a strong bearish rejection candle after sweeping prior highs. This rapid reversal after liquidity sweep is the hallmark of successful LSR strategy implementation. 📍

The volume profile during the sweep shows increased activity followed by immediate selling pressure, indicating institutional players have completed their accumulation and are now driving price lower toward our target zone. 📊

🎯Trade Plan Execution (SELL Order)

Our entry zone at $12,240.0 represents the optimal re-entry point near the liquidity sweep high, providing excellent risk-reward positioning. This level allows us to position with institutional flow while maintaining tight risk management. 🎯

The stop loss at $12,260.0 is strategically placed just above the highest point of the liquidity sweep, providing a clear invalidation level. This tight stop ensures minimal risk exposure while allowing the trade thesis to develop. 🛑

Our take profit target at $12,100.0 aligns with previous M5 demand zones and swing lows, representing a high-probability support area where institutional buyers may re-enter. This provides a favorable 7:1 risk-reward ratio. 💚

This setup capitalizes on the expectation that the liquidity sweep has exhausted buying pressure, and price will now reverse downward as institutional players drive the market toward their intended direction. 🌊

🧠Psychological Market Dynamics

The LSR strategy exploits retail trader psychology where breakout traders enter long positions above resistance, only to be trapped when institutional players reverse the market. This creates optimal short entry conditions. 🎭

Understanding that 90% of retail traders lose money by chasing breakouts, we position ourselves with the smart money flow, taking advantage of their predictable behavior patterns during Tokyo session liquidity sweeps. 🧩

Conclusion & Key Takeaways 🎓

🌟 Trading Wisdom

Trading isn't just about finding the perfect setup; it's a journey of continuous learning and emotional discipline. Remember, even the best analyses can't predict the future with 100% certainty. Embrace uncertainty, manage your emotions, and let your strategy guide you. 🧠✨

The market will always present new opportunities. Keep your mind clear and your focus sharp! Success in cryptocurrency trading comes from patience, discipline, and consistent application of proven methodologies like the LSR strategy. 🚀

⚠️Risk Management Note

Always ensure your position size aligns with your overall risk tolerance. Never risk more than a small percentage of your total capital on any single trade. This setup is based on a fixed dollar risk of $500. 💰

Adjust your lot size according to your personal risk management rules and account size. Cryptocurrency markets are highly volatile - proper risk management is essential for long-term success. 📊

🎯Key LSR Strategy Points

- ✅Focus on Tokyo session for optimal LSR setups

- ✅Identify liquidity sweeps above recent highs/lows

- ✅Wait for immediate rejection after sweep completion

- ✅Use tight stops above/below sweep levels

- ✅Target previous support/resistance zones

- ✅Maintain strict risk management protocols