Introduction to GBP/JPY Analysis 🎯

Welcome to our comprehensive analysis of the GBP/JPY currency pair using the powerful Liquidity Sweep Reversal (LSR) strategy! 🚀 As professional traders, we understand that the GBP/JPY cross is one of the most volatile and opportunity-rich pairs in the forex market, especially during the Tokyo session when Japanese institutional activity peaks.

🎌 Why GBP/JPY During Tokyo Session?

- 🏦 Institutional Activity: Japanese banks and financial institutions are most active

- 📊 High Volatility: Perfect for capturing significant price movements

- 🎯 Clear Liquidity Zones: Well-defined areas where stops cluster

- ⚡ Quick Reversals: Ideal for LSR strategy implementation

In this analysis, we'll dive deep into a SELL LIMIT setup at 202.720 with a target of 202.200, demonstrating how AI-enhanced analysis can identify high-probability reversal points with precision. 🎯

Understanding Liquidity Sweep Reversal (LSR) 🌊

The Liquidity Sweep Reversal (LSR) strategy is a sophisticated approach that capitalizes on institutional behavior patterns. Smart money creates liquidity raids to absorb retail orders before reversing direction, creating high-probability trading opportunities for those who understand the mechanics. 🧠

🔑 Key LSR Components:

- 📍 Liquidity Pools: Areas where stop losses cluster (equal highs/lows)

- 🏗️ Market Structure: Break of structure (BOS) and change of character (CHoCH)

- ⚡ Fair Value Gaps: Price imbalances needing to be filled

- 🎯 Order Blocks: Institutional order placement areas

- ⏱️ Session-based entries: Optimal timing during high-activity periods

The strategy works by identifying when price sweeps above recent highs to trigger retail stop losses, then quickly reverses as institutions enter in the opposite direction. This creates a "false breakout" scenario that savvy traders can exploit. 💡

🎯 LSR Psychology Breakdown

Retail Accumulation: Traders place stops above recent highs

Institutional Sweep: Smart money pushes price to trigger stops

Liquidity Absorption: Orders are filled at favorable prices

Reversal Execution: Price moves in intended direction

Strategy Implementation & Timing ⏰

🌟 Optimal LSR Trading Windows

🎌 Tokyo Session

Time: 00:00 - 09:00 GMT

Best for: JPY strength plays, institutional activity

🇬🇧 London Open

Time: 08:00 - 10:00 GMT

Best for: GBP volatility, session overlaps

🔍 Implementation Steps

- Market Analysis: Identify higher timeframe structure and liquidity pools

- Session Timing: Focus on Tokyo session for optimal GBP/JPY setups

- Entry Execution: Look for liquidity raids followed by change of character

- Risk Management: Place stops beyond sweep levels with proper sizing

- Target Selection: Aim for previous swing lows or support levels

Live Trading Setup Analysis 📊

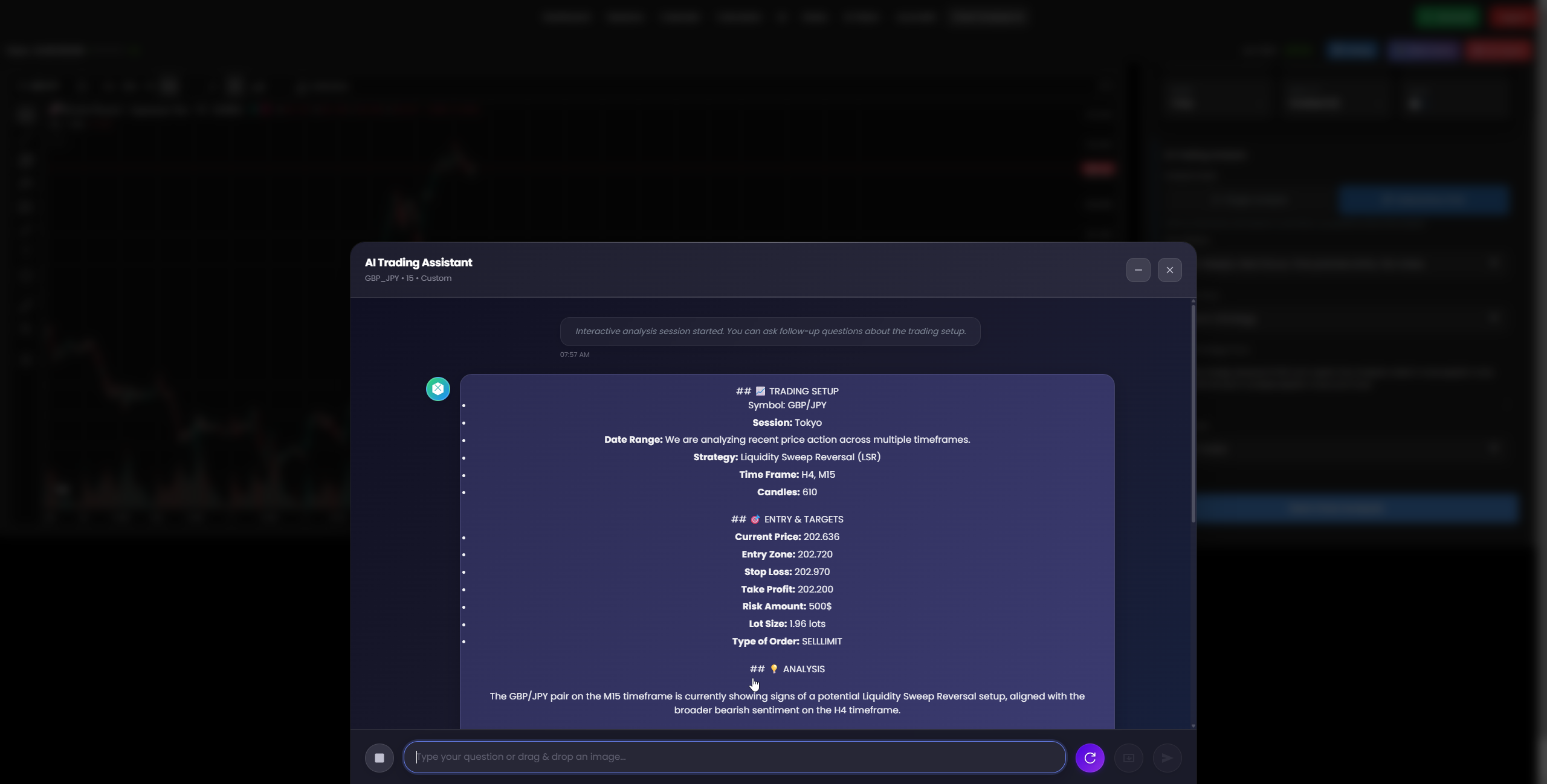

📈Trading Setup

🎯Entry & Targets

💡Comprehensive Market Analysis

The GBP/JPY pair on the M15 timeframe is currently exhibiting classic signs of a Liquidity Sweep Reversal setup, perfectly aligned with the broader bearish sentiment observed on the H4 timeframe. This confluence creates an exceptional trading opportunity for disciplined traders who understand institutional behavior patterns. 🎯

📊 Recent Price Action Analysis

Examining the latest M15 candles reveals a fascinating story of institutional manipulation and retail trap execution:

- 🕐 Candle 2: (Open: 202.680, High: 202.704, Low: 202.628, Close: 202.696) - Initial bullish momentum building

- 🕐 Candle 1: (Open: 202.702, High: 202.706, Low: 202.632, Close: 202.636) - The critical reversal candle

⚡ The Liquidity Sweep Mechanics

The rally was strategically rejected at a critical juncture. The high of candle 1 at 202.706 briefly pushed above the prior swing high around 202.700 (established by previous candles, including candle 2's high at 202.704 and candle 28's high at 202.984). This precise movement represents a textbook liquidity sweep designed to trap late buyers who entered on the apparent breakout. 🪤

The subsequent strong bearish close of candle 1 at 202.636, significantly below its open and near its low, provides definitive confirmation of the rejection and signals a high-probability reversal scenario. This pattern suggests that the initial upward movement was a false breakout engineered to absorb liquidity before the intended downward move.

📈 Higher Timeframe Context (H4 Analysis)

On the higher timeframe (H4), the market has been maintaining a sustained uptrend, but the most recent H4 candles (specifically candles 483 and 482) demonstrate a clear struggle to continue the bullish momentum. The presence of significant wicks around the 202.900-203.000 area indicates institutional exhaustion and potential distribution. 📊

This suggests that our current M15 liquidity sweep could represent either:

- • A short-term reversal within a larger retracement before potential H4 trend continuation

- • The beginning of a deeper correction as institutional players shift sentiment

🎯 Trade Rationale & Execution Strategy

Given the clear liquidity sweep above recent highs on the M15 timeframe and the strong bearish rejection that followed, we anticipate a significant downward movement. Our SELL LIMIT order placed at 202.720 (slightly above the current price and within the zone of the recent high) offers an excellent risk-reward profile. 💰

The Stop Loss at 202.970 is strategically placed above the high of the liquidity sweep to protect against further upward movement, while our Take Profit at 202.200 targets a recent significant low, aiming for a favorable risk-reward ratio of approximately 1:2.08.

This setup exemplifies how understanding institutional behavior patterns and liquidity dynamics can provide traders with high-probability opportunities that align with smart money flow rather than fighting against it. 🧠

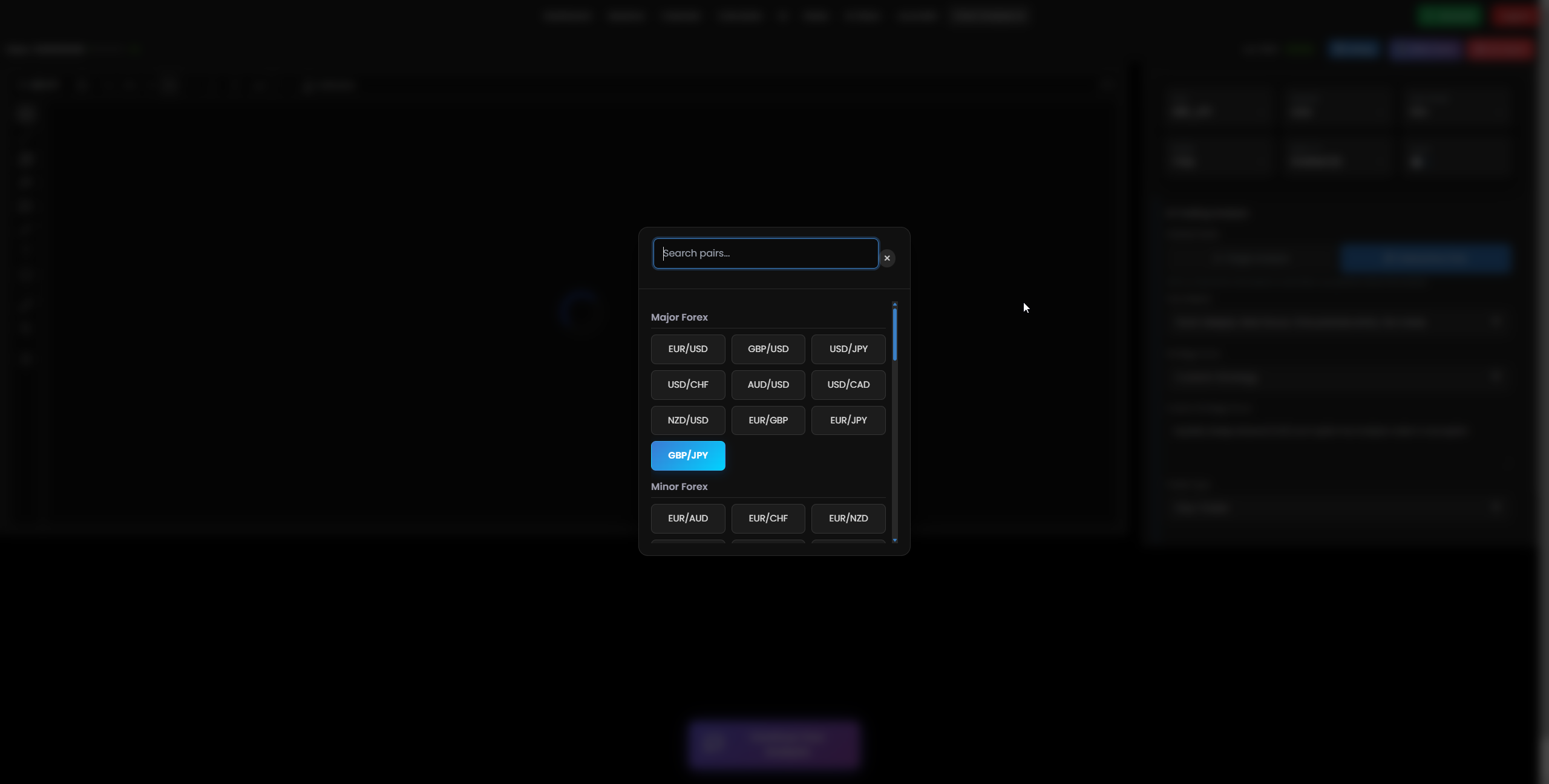

📊 Pair Interface Analysis

GBP/JPY pair interface showing current market structure, liquidity zones, and key price levels for LSR strategy implementation

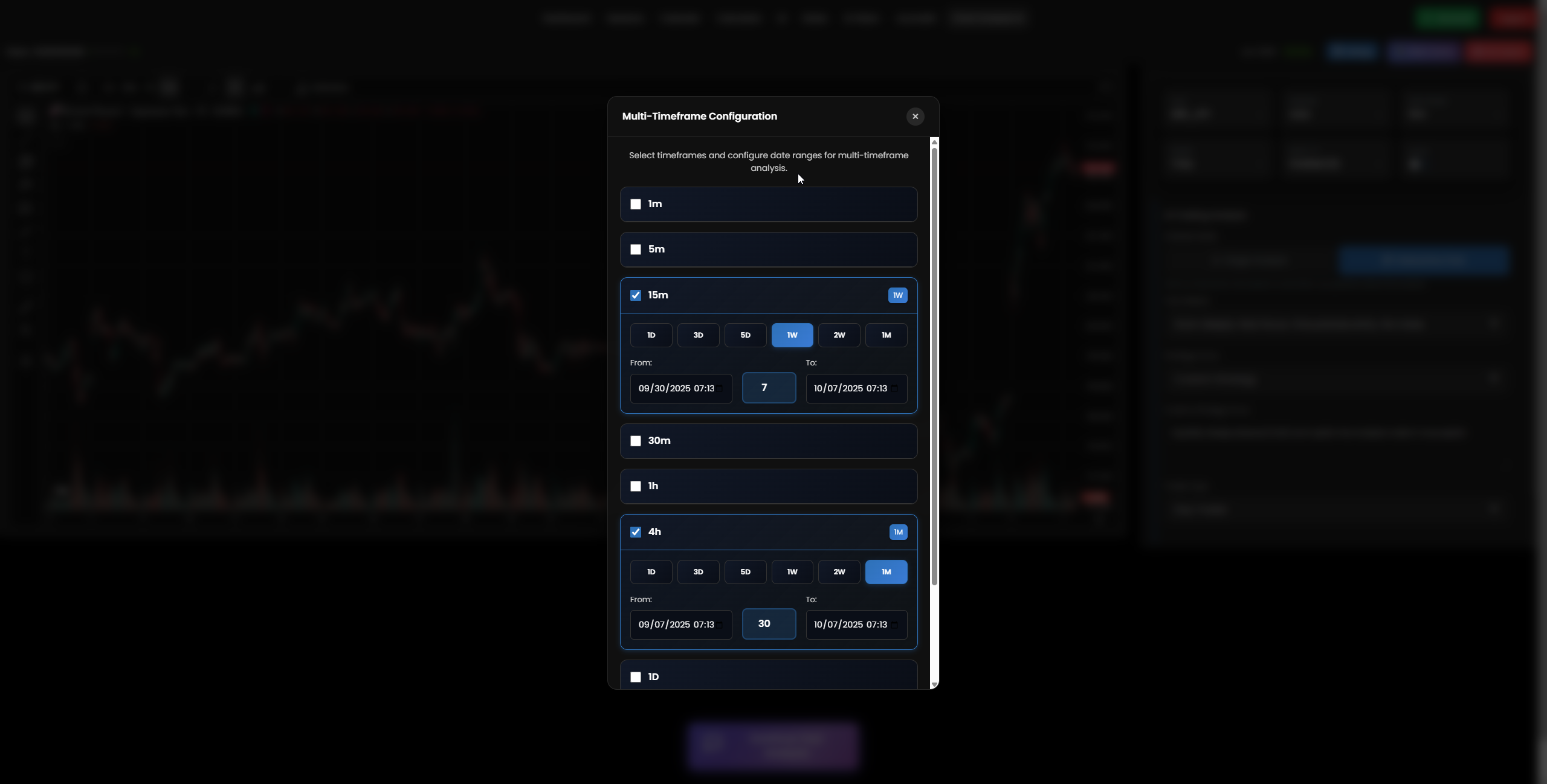

⏰ Time Frame Analysis

Multi-timeframe analysis showing H4 trend context and M15 entry precision for optimal trade execution

📈 Results Interface

Complete AI analysis results showing market structure, entry signals, risk assessment, and trading recommendations for GBP/JPY LSR strategy

Risk Management & AI Analysis 🛡️

📉 Stop Loss Strategy

- • Place beyond liquidity sweep level (202.970)

- • Risk maximum 1-2% per trade ($500 risk)

- • Use previous structure highs for protection

- • Account for spread and slippage in volatile pairs

- • Never move stop loss against your position

📈 Take Profit Targets

- • Target 1:2+ risk-reward ratio (202.200)

- • Use previous swing lows as targets

- • Consider daily/weekly support levels

- • Scale out at key psychological levels

- • Trail stops in profitable positions

🤖 AI Enhancement Features

AI analysis enhances the LSR strategy by processing multiple timeframes simultaneously, identifying confluence factors, and calculating optimal entry/exit points based on historical patterns and real-time market conditions specific to GBP/JPY volatility patterns.

- • Real-time sentiment analysis from news and social media

- • Historical pattern recognition for GBP/JPY behavior

- • Volatility-adjusted position sizing recommendations

- • Session-based probability calculations

- • Risk-reward optimization algorithms

🎥 AI Tools Demonstration Video

Step-by-step guide on using the AI trading tools interface for GBP/JPY analysis and trade execution

⚠️ Risk Management Note

Always ensure your position size aligns with your overall portfolio risk tolerance. Never risk more than you are comfortable losing on a single trade. Trading involves substantial risk and is not suitable for all investors. The GBP/JPY pair is particularly volatile and requires strict discipline and proper risk management. 🚨

Conclusion & Key Takeaways 🎯

The Liquidity Sweep Reversal strategy on GBP/JPY, when enhanced with AI analysis, provides a systematic approach to trading with higher probability setups and improved risk management. Success requires patience, discipline, and strict adherence to session timing, particularly during the Tokyo session when institutional activity peaks. 📊

✅ Key Success Factors

- • Master Tokyo session timing (00:00-09:00 GMT)

- • Identify liquidity pools accurately on GBP/JPY

- • Wait for clear change of character signals

- • Maintain strict risk management rules

- • Understand cross-currency volatility patterns

- • Use AI for confluence confirmation

- • Practice on demo before live trading

- • Keep detailed trading journal

- • Continuously refine your approach

- • Respect the power of GBP/JPY volatility

Remember, consistent profitability comes from executing a proven strategy with discipline rather than seeking perfect trades. The combination of LSR methodology and AI analysis provides the edge needed for long-term success in GBP/JPY trading. 🚀

🎉 Happy Trading!

Stay disciplined, stay focused, and remember that every professional trader started with a single well-executed trade. Your journey to consistent profitability begins with understanding and respecting the market's institutional behavior patterns. 🧠💪